Who Could Have Predicted This?

Meet the new domestic crude oil plan, same as the old one

As I mentioned in my previous piece on Dangote, fuel subsidies have been the all consuming story of the Nigerian government’s finances for the better part of the last decade and a half. They have proven impossible to get rid of no matter how much it consumes and Nigerians themselves have dug their heels in, in the belief that subsidised fuel is the only ‘benefit’ they get from their government.

But the fuel subsidies used to work in a different way 2 decades ago when democracy had just returned to Nigeria. Let’s start with a basic overview1:

Back then the government sold crude oil at a heavily discounted price to NNPC in naira on 60 day payment terms. The idea was that NNPC would refine this cheap crude and sell the petrol cheaply to Nigerians at a price that was ‘affordable’. This was essentially a loan, a discount and foreign exchange subsidy all wrapped into one given that the exchange rate was of course not market driven and always below the market rate. Since the government could not sell the same barrel of crude to two different people, this crude sold to NNPC on such generous terms meant a lot of badly needed foreign exchange was foregone.

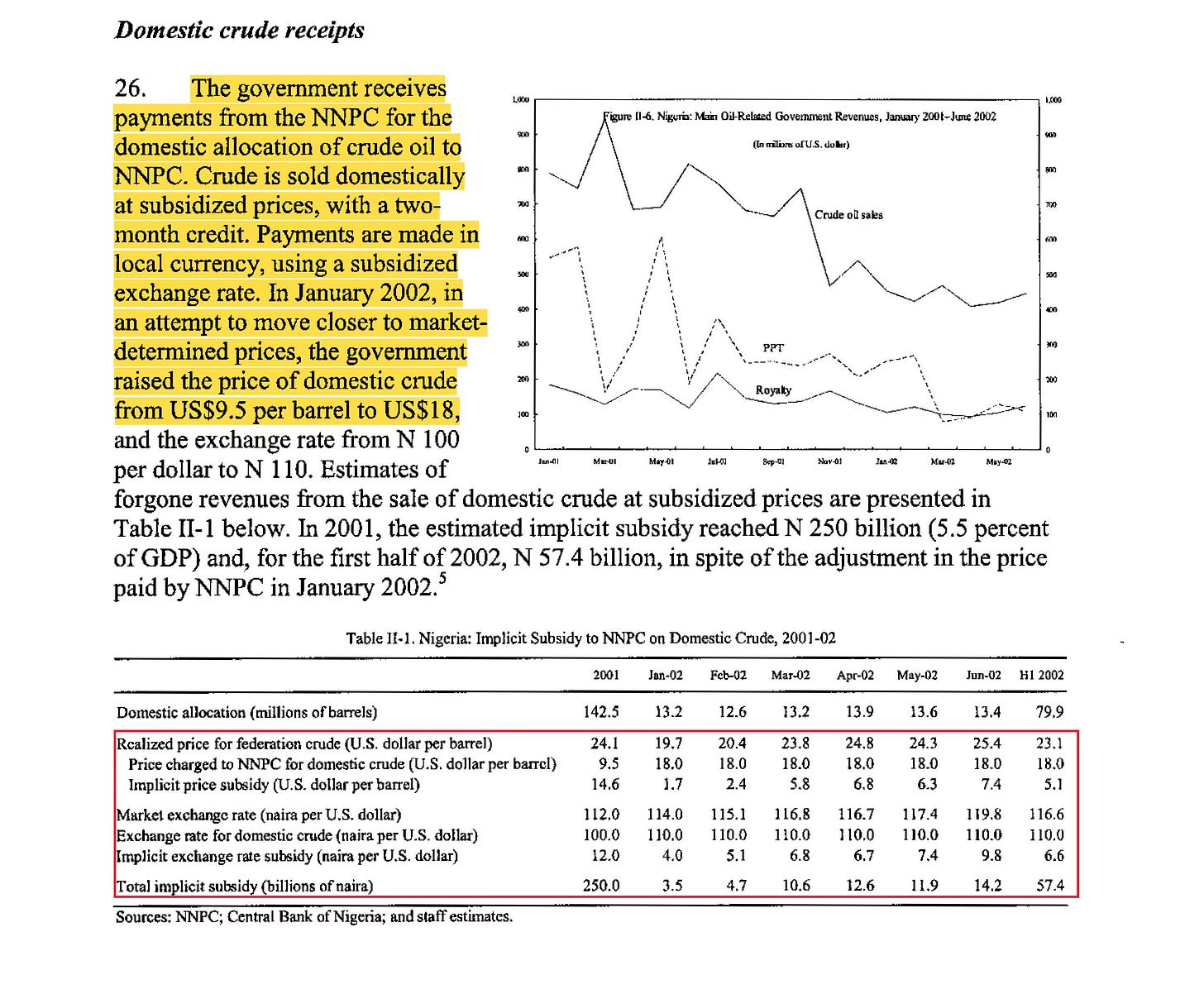

As the table above shows, the government was losing about $15 on each barrel of crude it sold to NNPC in 2001 amounting to an incredible 5.5% of GDP (something like $26bn in today’s economy). It was very hard to keep this state of affairs for a government that was badly broke and so in 2002, the price of crude sold to NNPC was adjusted upwards. But as can be seen from the table, even after the price NNPC paid was doubled, the foregone revenues continued to widen given that Nigeria had no control over the international price of crude which was rising.

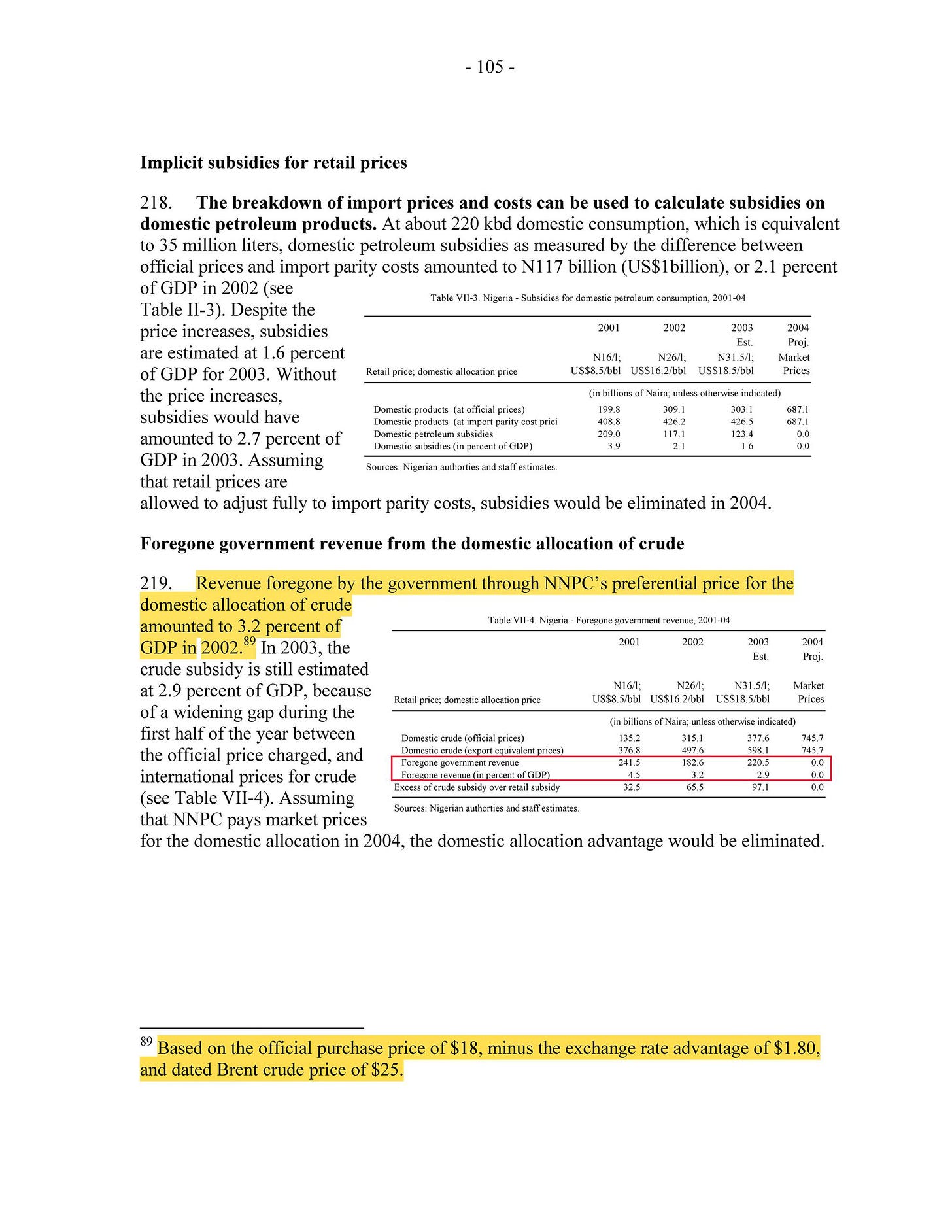

The table below makes this point clearer:

By 2003, the foregone revenues were almost back at where they were in 2001.

What happened next? You will win no prizes for guessing. Something worth $25 per barrel was being sold to NNPC at $18 per barrel. It is very difficult to resist this kind of temptation especially when you are NNPC and in Nigeria:

NNPC simply took the crude it bought from the government at $18 and exported them to sell at $25. This was easy money and profit for literally nothing. I don’t trust myself not to have done the same thing. This export business was the driver of NNPC’s profits in 2002 (yes, as hard as it is to believe and as utterly useless as NNPC is today, there was a time it actually made a profit).

NNPC was making a killing and of course NNPC officials had a field day helping themselves to the proceeds of this arbitrage.

Eventually President Obasanjo got so angry, cancelled the whole arrangement and sacked the NNPC Managing Director at the time, Jackson Gaius-Obaseki, a man who enjoyed the good life:

Calls for Gaius-Obaseki to be sacked reached a crescendo in September after he told a national daily that the NNPC had spent 224 million naira (US $1.7 million) to maintain two suites at the Abuja Hilton Hotel for him in the past four years. Gaius-Obaseki further outraged the public by declaring that staying in the hotel was a sacrifice he had to make for the nation as the expended amount was inadequate to build him befitting accommodation

You can also imagine that this created perverse incentives where NNPC now had a vested interest in ensuring the local refineries did not work so it could instead export the crude meant for those refineries.

Obasanjo scrapping the whole arrangement gave birth to the subsidy regime we have today where people would import petrol and claim the subsidy from the government at an agreed rate or NNPC would exchange its crude barrels for petrol products and pay the subsidy in the arrangement.

Guess who’s back?

Yesterday a ‘new’ policy was announced by the Bola Tinubu government. The Cable reports:

The federal executive council (FEC) has approved a proposal by President Bola Tinubu directing the Nigerian National Petroleum Company (NNPC) Limited to sell crude oil to Dangote Petroleum Refinery and other refineries in naira.

In a statement on X, Bayo Onanuga, special adviser on information and strategy to the president, said the African Export-Import Bank (Afreximbank) and other settlement banks in Nigeria will facilitate the trade between Dangote and NNPC.

FEC approved the proposal on Monday during a meeting presided over by Tinubu.

“To ensure the stability of the pump price of refined fuel and the dollar-Naira exchange rate, the Federal Executive Council today adopted a proposal by President Tinubu to sell crude to Dangote Refinery and other upcoming refineries in Naira,” Onanuga said.

“Dangote Refinery at the moment requires 15 cargoes of crude, at a cost of $13.5 billion yearly. NNPC has committed to supply four.

“But the FEC has approved that the 450,000 barrels meant for domestic consumption be offered in Naira to Nigerian refineries, using the Dangote refinery as pilot. The exchange rate will be fixed for the duration of this transaction.”

And so more than 2 decades after this same policy was cancelled because it was so expensive and corrupt, it has been resuscitated in the name of the Dangote Refinery. The crude will be paid for in naira and the exchange rate will be ‘fixed’ meaning there will be a big subsidy there. Of course there will be favourable payment terms meaning there will also be a credit component to the arrangement. And of course, every barrel of crude sold to Dangote in naira is a barrel that cannot earn dollars for Nigeria.

This is classic Dangote: partner the government to allow him extract the maximum profits while ensuring he pays zero taxes on the profits. There is nothing stopping him from taking the crude sold to him in naira at a discount and simply exporting it to the international market for a quick profit. But there is another aspect that will allow him obtain maximum profits:

Subsidy for me, market price for you

This arrangement to sell him subsidised crude in naira is only to allow to him produce and sell gasoline (petrol) for the Nigerian market. But that is only one of about 8 products that the refinery will produce. All the other products can be sold for their full market value in Nigeria or on the international market. But it is the same crude that will be used to produce petrol and diesel or jet fuel. That is to say, Dangote is going to receive a major profit boost from having access to cheaper inputs to make products that require no subsidy. This is not theoretical: something similar has happened very recently with the same Dangote and urea:

He got a 25 year sweetheart deal (driven by the government) for gas to produce fertiliser at a fraction of international prices.

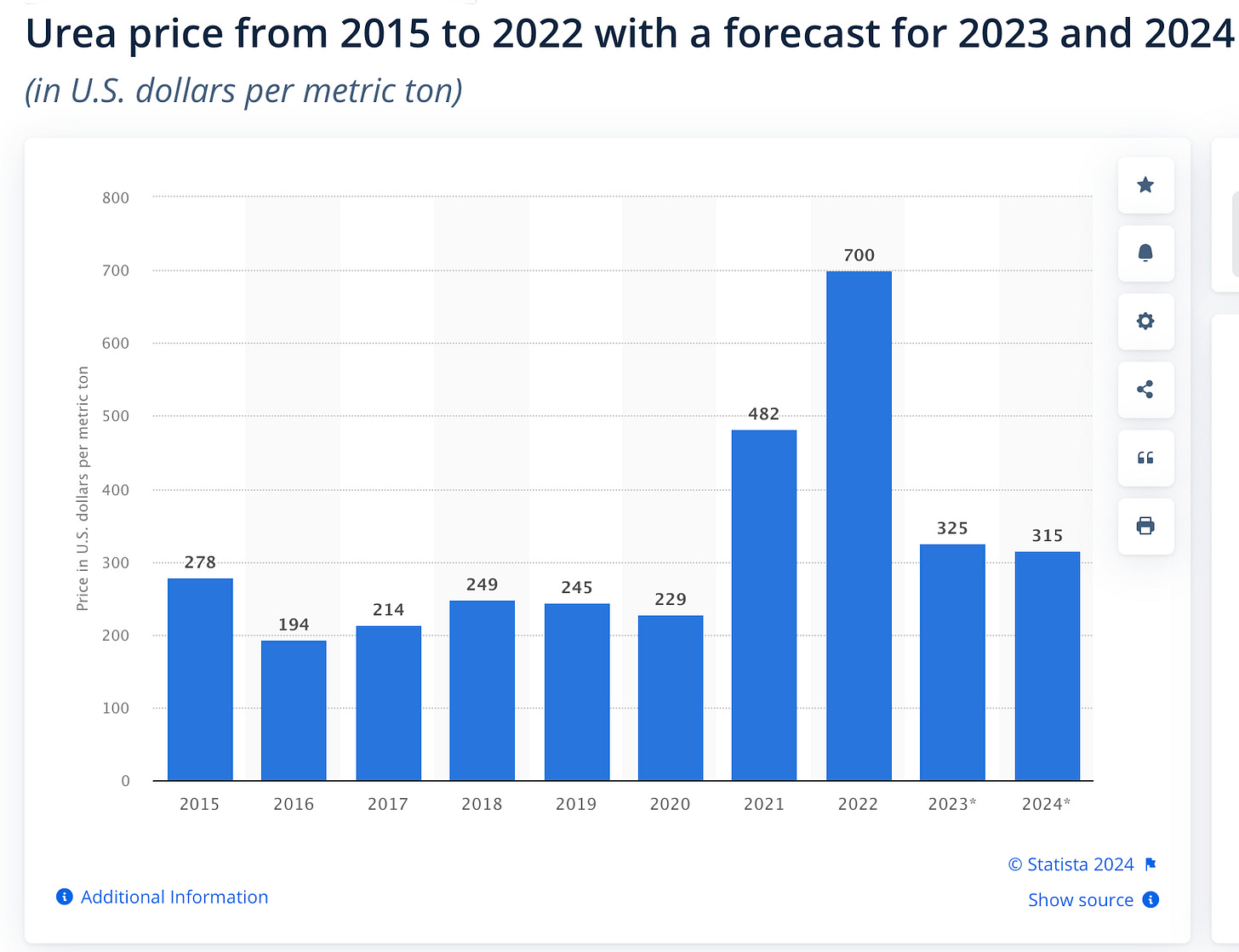

Having obtained this very good deal, he has been exporting the majority of the urea produced. By something of a coincidence, Putin invaded Ukraine early in 2022 and urea prices spiked:

Here’s how The Federal Reserve put it:

The price of fertilizer, which is among farmers’ greatest expenses, reached all-time highs in the spring of 2022 after Russia, the world’s top fertilizer exporter, invaded Ukraine in February. The Russia-Ukraine war exacerbated an already tight global supply situation that had begun in 2020 with COVID-19-related worker shortages and factory shutdowns, the first of several disruptions that sparked volatility in the fertilizer market.

In response to economic sanctions imposed by the international community, Russia halted hundreds of exports. While fertilizer exports were not explicitly banned, Russia’s Ministry of Industry and Trade recommended that its fertilizer manufacturers temporarily stop exports of their products amid shipping concerns. Russia later announced further export restrictions on fertilizer that will last through May 2023 to secure sufficient supply for domestic farmers. In addition, shipping companies, as well as Western financing and vessel insurance companies, steered away from Russia amid international financial sanctions and safety concerns. The result was that global and U.S. fertilizer prices surged to record levels in March 2022.1 According to the World Bank, global fertilizer prices had risen 30% by early 2022 on the heels of an 80% hike in 2021.

In any other country, this should have prompted a windfall tax on the profits Dangote made from this spike in prices given that he was receiving subsidised inputs backed by the government. And the fertiliser plant is of course subject to the ‘pioneer status’ incentive which he has used aggressively to avoid paying taxes over the years. Even when Nigeria was suffering crippling food inflation as a result of high input costs like fertiliser, Dangote Fertiliser did not budge. It sounds crazy but true: last year, urea prices in Brazil were cheaper than in Nigeria and Nigeria is the 3rd largest exporter of urea to Brazil.

So returning to the earlier point: there should be zero surprises when Dangote takes his cheap subsidised crude from Nigeria, produces various products and exports them for very fat margins that no one else in the world can earn. His wealth and status will go up and then everyone will be in awe of his business genius.

A simple alternative arrangement

Was there no other way for Nigeria to have done this? Of course there was. A country with a habit of learning from past mistakes would have taken a different approach to all of this. I spoke to a good friend of mine with a very sound knowledge of the oil industry and here’s the alternative he came up with:

1. The Board of NNPC considers and approves a request from the majority shareholder for NNPC to competitively sell its equity crude every quarter from the assets managed under a competitive bid round with preference for domestic refiners

2. Domestic refiners pay in NGN and provide letters of credit or guarantees and the FMDQ rate is used

3. Each domestic refiner cannot bid above its operating capacity calculated as last 3 months capacity utilisation divided by the installed capacity and this will be verified by a third party such as Argos or S&P

4. Excess crude after each allocation is sold competitively to foreign buyers

5. Board directs NNPC to spinoff the refining arm as a fully independent unit to create some sort of competition every quarter for the domestic crude purchase

What does this do?

1. Isolate the Government directly from this decision and shows that we are committed to a commercially run NOC and also presents a fall guy if this backfires (you can hold the board to account)

2. Encourages other people to invest in domestic refining because they are assured of local feedstock under competitive terms

3. We move from implicit subsidy to explicit subsidy

4. You might actually get a premium over the market price for crude because bidders might offer a premium because of the other products available after refining. You are using NGN to buy a product you will sell in USD after processing

The title of this post is a future headline. When the inevitable scandal and corruption happens from the government selling a subsidised product to a chosen few (and when there are still fuel scarcities given the incentives at play), there will be stories in the papers acting like no one could have predicted this state of affairs.

Since this has been done before, there is no reason to expect things to be different this time around. If you do, I have a barrel of crude to sell to you. For you my friend, I give you good price.

Taken from IMF Selected Issues (2003 and 2004)

See them trying to rewrite history

"According to him, “In a nation of corrupt and insensitive leaders like ours, Dr. Jackson Gaius-Obaseki is one of the few who returned from retirement and is not accused of corruption and money laundering."

https://www.vanguardngr.com/2020/11/tributes-as-obaseki-former-nnpc-gmd-marks-75-years/

well, this is Dangote being Dangote and Nigeria being his sidepiece...

nothin new...