#TheCBNFiles: The Spending

This week on 1914 Reader, we are publishing a series of posts on the recently released financial statements of Nigeria’s Central Bank. This will be a mixture of analysis, opinion and guest posts. There is a lot of information in the accounts and we don’t believe that a single post can do justice to them.

Nobody prepares their accounts everyday. At most, some prepare on a monthly basis and others on a quarterly basis. For large organisations, things are of course monitored closely on a regular basis but the preparation of their full set of accounts is an onerous and time-consuming process that often happens a few weeks or months after the period for which the accounts are being prepared has closed.

So far, so obvious. But what this means is that sometimes the accounts are a way for the organisation itself to make sense of what it did during the year. I say all this because for us to understand the Central Bank of Nigeria’s recently released financial statements, we have work and think backwards to a great degree. The accounts run to nearly 200 pages and they contain a lot of words and numbers, many of which are confusing even to sad people like myself who read accounts for a living.

But maybe we should start from the beginning and the part’s that easiest to understand.

The above is straightforward — what the bank spent during the year and what it made that allowed it to spend that money. And of course the profit left over where its income was more than its spending.

Stages of credit losses

Before we get into the operating expenses, let’s quickly touch on the Credit loss expense line of N875 billion. This deserves a post of its own so this is only a quick summary. But the key point is that under IFRS 9 — the financial standard that governs how you account for financial instruments — you have to test any financial instruments you hold against possible losses. Say you lent someone N100 and you see that the person’s business has blown up and he has stopped repaying the loan. You have to work out how likely it is that you will ever get your money back and then book the loss in your accounts.

IFRS 9 helpfully allows you measure this potential loss in stages — 1, 2 and 3. In stage 1, things are not so bad and nothing dramatic has happened in the last year to make you think you are now less likely to get your money back. Stage 2 is quite bad and the risk of never getting your money back has increased significantly so you know you’re going to take a loss. By Stage 3, the loss has already happened and there is no going back or hiding from it.

CBN looked at all its various financial instruments and worked out losess between stages 1 to 3 of an eye-watering N875 billion as below:

The vast majority of those losses — 85 per cent — are in stage 3. Or as the Nigerian dancer turned musician, Poco Lee, sang — o ti lo i.e Izz gone. But where did it go? CBN says the losses come from loans and receivables it issued.

We shall talk about that in a separate post.

Parsing the expenses

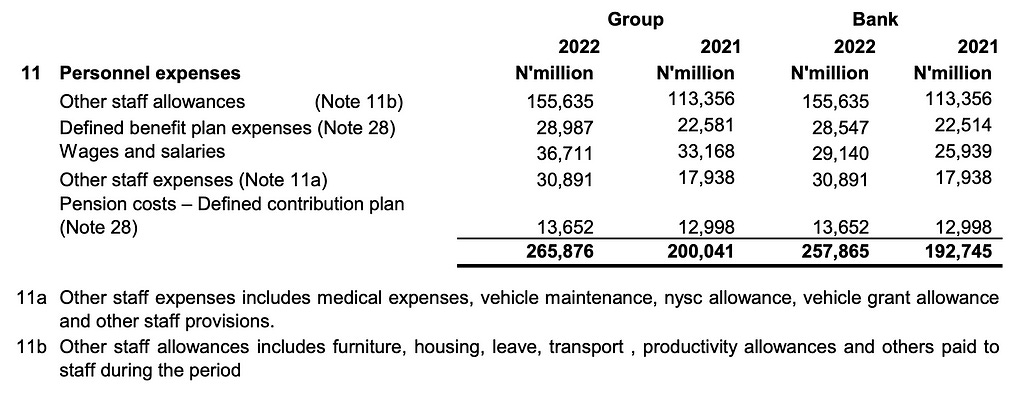

These are all very large numbers and one can easily lose a sense of scale when staring at them. But let’s get into the expenses — that part is mostly as real as it gets. As part of running the CBN, the bank incurred expenses of N1.218 trillion. Salaries and benefits have to be paid to the people working and we see that the CBN spent N266 billion on those.

All that is interesting here is that actual salaries only cost N37 billion with ‘allowances’ costing N156 billion. When a government agency has access to large resources, it will try as much as possible to capture those resources for itself i.e. the members of that agency. The monetisation rules were that all allowances should be included in salaries to avoid this specific problem where people were paying themselves far more than what the approved salary structures would allow. But not all government agencies are created equal and some continue to flout the rules without consequences.

The next set of items — depreciation and amortisation — are not real expenses in the sense that CBN did not pay cash to someone to depreciate a building somewhere. But at N35 billion, they are small fry (relatively!). It also costs money to print new notes and presumably move the physical notes across the country for Nigerians to use. But again, N29 billion for currency issue expenses is neither here nor there in these accounts.

That brings us to the biggest chunk — N888 billion filed under ‘Other operating expenses’.

Admin expenses of N127 billion is not explained any further. But that is where the cost of paper, pencils and photocopier toner would go. Since they don’t tell us more, we have to leave it at that. The N50 billion Banking sector resolution fund is a reminder of the damage from the banking crisis of 2009 which led to the creation of AMCON in 2010. CBN is committed to paying N500 billion over a 10 year period i.e. N50 billion a year (this should be coming to an end soon as CBN has been paying it since at least 2014.)

For many Nigerians, the only part of CBN’s functions they can really relate with is the myriad intervention activities the bank gets involved in like when the Central Bank funds the rearing of chickens via a poultry interventon. What these accounts show is how small those activities are relative to everything else in them. Sure they cost N125 billion in 2022 but remember that we are talking of total operating expenses of N1.218 trillion.

Spending money to make money

The only thing interesting about the N45 billion ‘cost of sales’ is that the CBN explains it as what it spends on the ‘production of notes and coins’. This sounds like what it cost the CBN to run NSPMC, its currency production subsidiary. So the CBN incurred N45 billion to produce notes and coins via NSMPC(?) and another N29 billion to issue the currency. Anyway, N74 billion on currency spending. Go to court.

When you deal with a lot of currencies, its inevitable that you are subject to movements that are sometimes favourable and sometimes not given that currency values move everyday. Suppose that you have $100 and you report your accounts in naira. At the end of last year, the $100 was worth N1,000 and you duly reported it as an asset of N1,000 in your accounts. One year later, you still own the $100 but this time the value has gone down to N900. You report the N900 in your accounts as an asset but the loss of value of N100 is reported as an expense in your accounts i.e. a loss even though you have not sold the dollars. Hence the ‘unrealised’.

The CBN deals with such a large amount of foreign currency that it recorded a loss of N346 billion on them during 2022. This sounds to me like it got involved in dealing with some foreign currency debt instruments that were very badly mispriced (by CBN) and got burnt. This is such a large amount that it deserves more than the one line explanation given by CBN in the accounts

Rebates

One more expense item. Last year when the CBN was desperate to get some dollars flowing into the Nigerian economy, it came up with a number of schemes to tempt said dollars into the country. One of those was something it called RT200. Given the temptation for many exporters to find a way to sell their dollar income on the black market or someone else who might offer them better rates than the official one, the CBN offered N65 for every $1 you brought back into the country and sold to someone else through the official Investors & Exporters Window (I&E). If you brought it back and sold it to yourself, you got N35. At the time, the CBN claimed the target of this scheme was to attract $200 billion into the Nigerian economy by 2025–2027. The CBN says it spent N137 billion on this scheme in 2022. Let’s use N50 as the average payment per dollar (N65 + N35 divided by 2). This suggests that the scheme that was planned to attract roughly $40 billion a year managed to attract $2.7 billion last year [Edited: Thanks to Ore Ogunbiyi for spotting!). Even more amusing is what might have happened if it actually attracted the $40 billion it aimed for. There is no cap on the payments so would CBN have spent more than N1 trillion on this scheme?

There was another scheme called Naira 4 Dollar that did something similar. But in this case it targeted individuals receiving remittances from abroad. Again, the problem here has been that a lot of remittances are simply ‘exchanged’ these days without any money actually ever flowing into Nigeria. So you want to send $500 to Nigeria and then you find someone in Nigeria who needs $500 in America. The person pays the naira equivalent into your Nigerian bank account or to someone else and you pay the $500 into the US account of the person or a nominated recipient. This scheme offered to pay N5 for every dollar you sent to Nigeria using a registered money transfer operator i.e. guaranteeing that the money actually made it to Nigeria. The CBN does not say in the accounts how much it spent on Naira 4 Dollar in 2022 but it said it cost N4 billion in 2021. We can thus deduce that it cost N18 billion (what’s left of the N155 billion spent on rebates after deducting the N137 billion for RT200) i.e. this wheeze presumably attracted $3.6 billion. How much of this is money that people would have sent through registered operators anyway and how much can be credited to the scheme? The answer is blowing in the wind.

There is also the irony that the scheme for individuals seemed to ‘attract’ more dollars than the scheme for exporters. It is better for us not to talk about what this says about the nature of the Nigerian economy so I shall leave it there.

Anyway, both these schemes have since been abolished as part of the new government’s fx reforms.

The rest of the expenses are not really worth getting into as the above covers the bulk of the operating expenses other than the slightly eyebrow raising N1.6 billion on ‘Directors’ related expenses’. But again, when you’re dealing with hundreds of billions, amounts like these hardly register.

The way things were

It is useful to go back to 2015 to get a sense of how the CBN’s spending has grown dramatically during the Emefiele years. Here’s what the Other operating expenses looked like for 2015:

Operating expenses have more than trebled in total and you see how the CBN has really become a dollar chasing organisation over time — the more it tries to ‘manage the exchange rate’ the more it proves to be a consuming fire devouring the CBN itself. The unrealised losses on fx and rebate payments on fx in 2022 cost more than N500 billion together. In 2015 these did not even exist.

The counterfactual

Now we’ve broken down the N1.218 trillion the CBN spent in 2022, it is worth considering an alternative scenario. As mentioned earlier, these amounts all had to go through the accounts meaning that it was a straightforward matter of making a loss if the CBN could not find revenues to cover those expenses or making a profit if it did.

Making a loss would be out of the question because when you do so, that loss is deducted against your equity otherwise how else do you fund expenses if you don’t have revenues to do so? The CBN operates on very thin equity with which to bear any losses. It only has N5 billion of share capital and N720 billion in retained earnings (i.e. the profit it has built up over time which is available as a buffer against losses). When you spend N1.218 trillion in a year, it does not take much for your reserves to be wiped out if something goes wrong.

Thus, when you add the credit losses of N875 billion to the operating expenses of N1.218 trillion, you are already over N2 trillion of earnings that must be found to avoid a loss that starts to eat into your reserves. It’s a hairy situation and explains why at the start I said that sometimes, you get to the end of the accounting period before realising what you have done.

The CBN of course did not make a loss in 2022. It managed a profit of just over N100 billion.

In the next post, we will be looking at how it found the earnings to cover these losses.

#TheCBNFiles: The Spending was originally published in 1914 Reader on Medium, where people are continuing the conversation by highlighting and responding to this story.