RFCC and Refining: An Explainer

RFCC, what is it good for? Definitely something

The tagline for this Substack is “a space for Tobi Lawson and Feyi Fawehinmi to read and think in public.” This post is going to attempt to live up to that. The matter at hand I want to try to think through is Resid Fluid Catalytic Cracking or RFCC. To be honest when I first heard of it, I initially thought it was the agency in charge of prosecuting corruption in the oil industry or something of the sort.

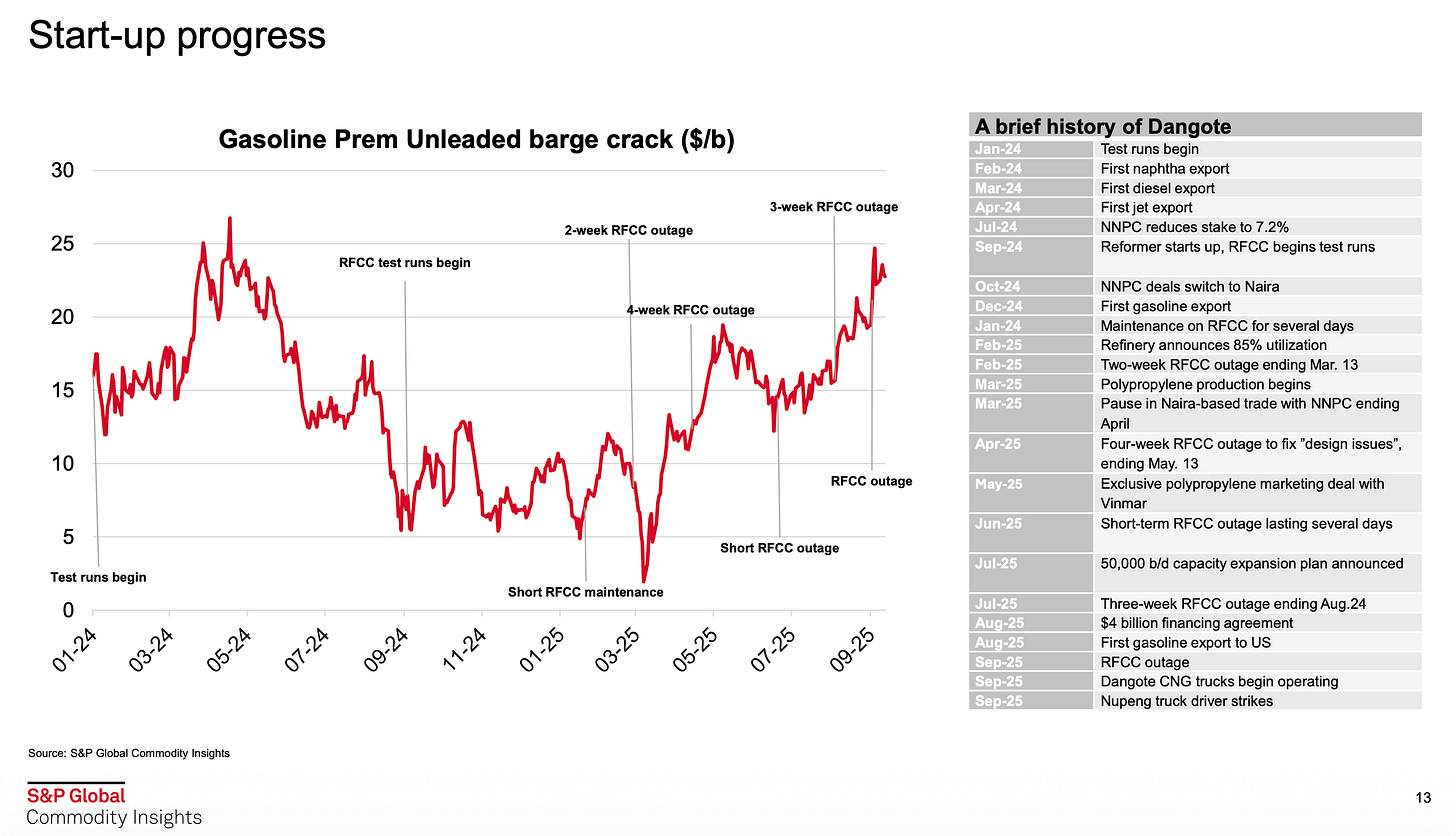

More seriously, what caught my attention was this chart from the S&P Global Dangote Refinery Update from a couple of months ago:

The chart left me confused and then not long after I saw this from the Kpler monthly global refinery status update for September (no indentation):

Nigeria

Nigeria’s refining remains constrained, with Dangote stuck in a maintenance loop, whereas legacy plants are struggling to run reliably.

Nigeria is striving to boost domestic refining capacity, anchored by the ongoing ramp-up at the Dangote refinery—though output remains capped at ~450–470 kbd due to RFCC and operational issues—and revival attempts at state-run plants. The state-owned refineries remain largely offline or only intermittently active. Port Harcourt and Kaduna are still in protracted repair phases with no clear restart dates, while Warri, which briefly resumed in late 2024, was shut again in 2025 after running at just 20–25% capacity, producing mostly residuals. These persistent setbacks underscore the difficulties in restoring reliable state-owned refining, keeping Nigeria dependent on imports in the near term.

Dangote Refinery-The refinery ramp-up is constrained as the RFCC remains under maintenance

The 650 kbd Dangote Refinery has made solid operational progress, commissioning all major units—including the reformer, isomerization unit, mild hydrocracker, and RFCC gasoline desulfurization (GDS) unit. However, persistent issues at the RFCC plant have kept the refinery on its back foot.

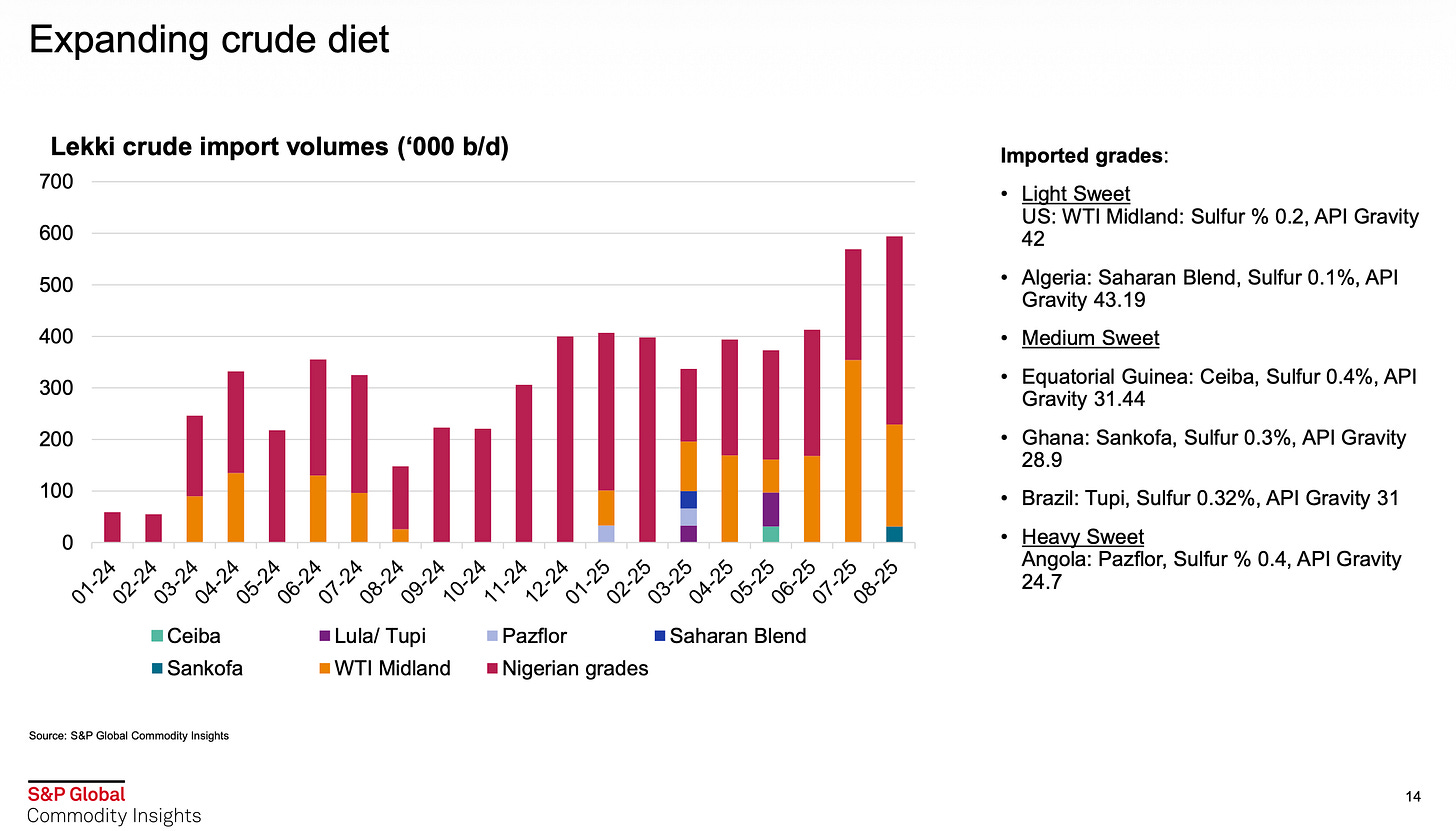

To manage bottom-of-the-barrel feed amid RFCC reliability issues, the refinery has maintained a light, sweet, and consistent crude slate—about 60% Nigerian light gradesand 35% imported WTI in 2025. The average crude API has held near 38 so far this year, a trend expected to continue into Q4 and early Q1 2026. At the same time, the refinery is adding new regional grades to diversify supply and reduce logistical risks.

Operational forecast: The RFCC has faced persistent reliability issues in 2025, suffering near-biweekly outages since April, and is currently offline until 10 December after repeated problems. Even during ramp-up, the unit has operated at only ~60-70% capacity, with recurring reactor and regenerator failures disrupting stability. As a result, overall refinery runs are expected to ease to ~420–450 kbd versus the earlier ~490–500 kbd. To offset the loss, the refinery is turning to lighter crude grades to keep CDU-linked secondary units active and may also import naphtha cargoes to keep gasoline production up, a strategy used previously to sustain supply. These setbacks have shifted yields, disrupted trade flows, and kept slurry output high, pushing fuel oil production to 85–95 kbd and gasoline production declining to around 100-120 kbd.

I should begin by emphasising that what follows is neither judgement nor opinion. My aim is simply to present the facts as clearly as I understand them, as there appears to be a marked absence of accessible reporting on this subject. Most available material comes from industry insiders, written in technical language that can prove impenetrable to the lay reader - myself included. Having spent considerable time attempting to educate myself on the matter, I offer here what (I think) I have learnt. In other words, I am trying to write the type of article I would like to read in mainstream local media if I lived in a country where a massive $20 billion refinery, with significant implications for the country’s financial sector and wider economy, had just opened.

What is RFCC?

Refining is generally a business of narrow margins, where every last drop of oil is important. One might consider RFCC as a process designed to ensure that nothing goes to waste. When crude oil first arrives at a refinery, it is separated into its various components within what are known as distillation towers. The heaviest and least valuable product of this distillation is termed “resid”. In its raw state, it possesses almost no commercial value; the only means of rendering it marketable is to transform it into something “lighter”. Petrol, diesel, and other petrochemicals all fall within this category of lighter fuels.

What we know as RFCC began in Kentucky, USA around 1983. Before that, the process of converting heavy oils into lighter ones involved applying a lot of heat and pressure. This process worked but the product that came out had lower octane levels (more on this later) and it damaged the equipment used in the process much quicker.

The process today operates in the following manner. First, the very heavy oil - that resid - is fed into a vertical pipe where it encounters an extremely hot, powdery “catalyst”. This vaporises the heavy oil and “cracks” the large molecules within it. What occurs next… I confess I don’t entirely grasp this stage, but eventually the catalyst is separated from products such as LPG, petrol, diesel, and various other oils. The separated catalyst is then regenerated through burning off the coke deposits within it. The purpose of this stage is to enable the catalyst to be reused - and as we noted at the outset, refining operates on such slender margins that the ability to reuse a catalyst in this fashion proves quite significant. RFCC also forgoes the use of hydrogen as a catalyst, which represents another avenue for cost savings.

If all of that is not enough for you, you can read more here. The key thing I wanted to establish here is that RFCC breaks down heavy oils distilled from crude not crude itself and that breaking down here means splitting big hydrocarbon molecules into smaller ones using a hot reusable catalyst i.e. catalytic cracking.

Common or Uncommon?

Having gotten an idea of what the RFCC does, the next thing I wanted to know was (1) how common it is for the RFCC units in a refinery to break down and (2) how common it is specifically in brand new refineries like the Dangote Refinery.

RFCC difficulties are far from uncommon, from what I understand. Whilst I have attempted to describe the process in four paragraphs above, these are in fact exceedingly complex units within a refinery, prone to leaks, fires, and particular problems during catalyst regeneration (they appear capable of igniting once more during this stage), as well as occasional complete loss of the catalyst itself. At times they simply experience unplanned outages necessitating shutdown. An amusing observation in the Kpler report noted that Ukrainian drone strikes on Russian refineries “have been highly targeted, hitting core processing units such as crude distillation towers, FCCs, hydrocrackers, reformers, and desulphurisation systems.” The Ukrainians evidently possess a keen understanding of what constitutes the most critical part in a refinery.

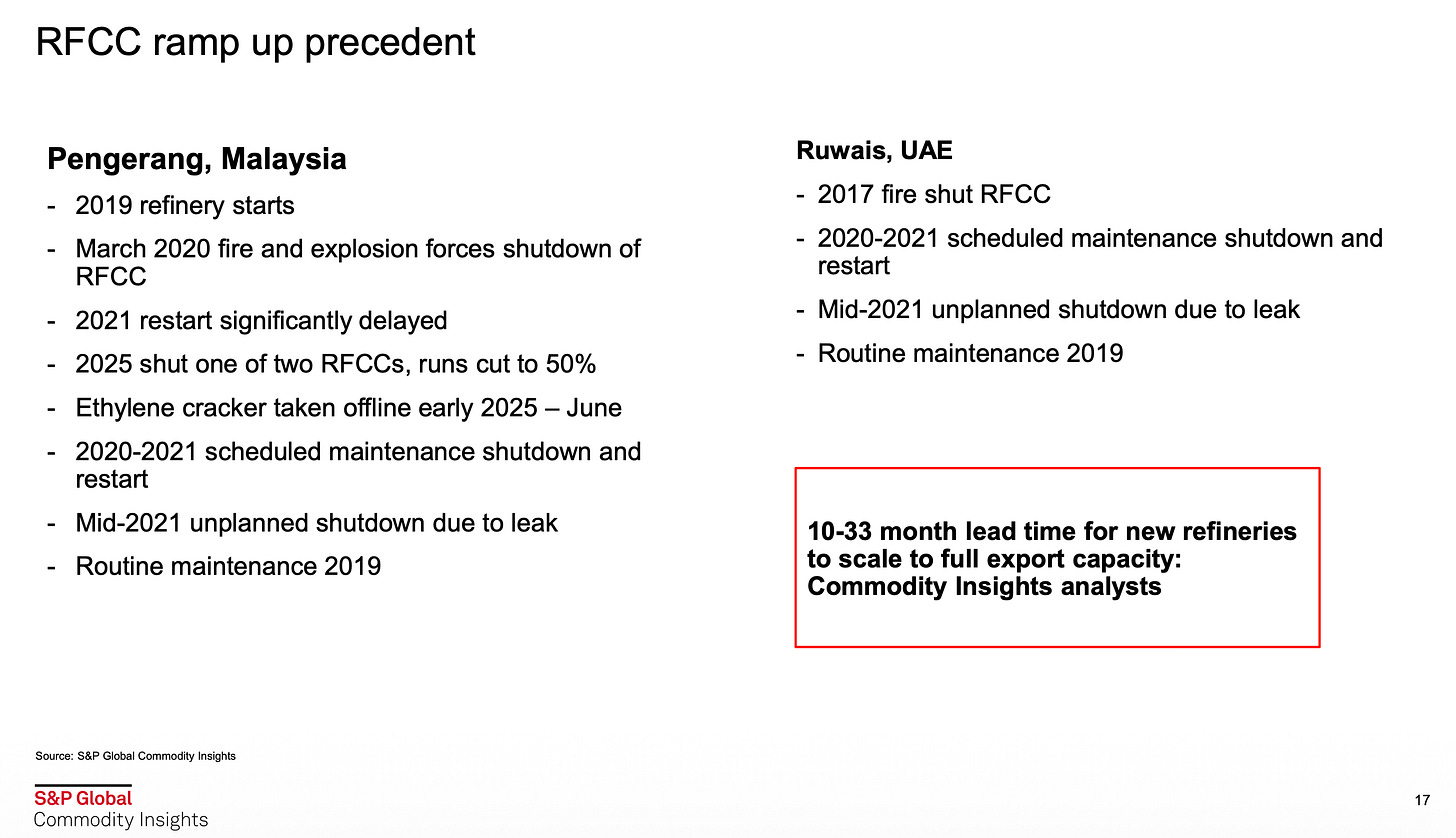

To the second point about brand new refineries specifically, is also not uncommon. Elsewhere in the S&P Global report is this slide:

Based on these two examples, S&P Global estimates that anywhere between 10 - 33 months is required for a new refinery to get over any RFCC problems it might have. The Dangote Refinery is well within that range, so nothing unusual right? The answer is a bit more complicated.

I found a few more RFCC issues beyond the two in the S&P Global report. Three years ago at the S-Oil Onsan refinery in South Korea, there was a blast at one of the RFCC units (one person died) but the company managed to get it back up and running “within days”. A year later in Vietnam, Nghi Son, the largest refinery in the country, suffered a leak in its RFCC unit which cut the refinery’s output by up to 25% for about 10 days. Back in 2017, there was a RFCC fire at a massive PetroChina refinery in Dalian, China. The fire was contained in two hours and a refinery source at the time said “there may be a small reduction in output at the gas separation unit as a result of the incident”. In 2018 at the Husky Superior Refinery in Wisconsin, USA, there was a RFCC fire while the refinery was actually shut down leading to 36 injuries and more than $500 million in damages. The report on the incident by the US Chemical Safety and Hazard Investigation Board (PDF, from page 45) is worth scanning through as it has lots of pictures of the site.

Just this past June, there was a RFCC fire at the Marathon refinery in Galveston Bay, Texas (the second largest refinery in the US). There were no injuries reported and at the time, it was expected to be out of service for an unknown period. A couple of weeks ago, it was reported that the RFCC unit had restarted operations. Finally, at the Exxon Mobil Beaumont refinery in Texas, a “malfunction” forced a shutdown of the RFCC unit in October but it was restarted in 48 hours.

I am certain there are further examples I have omitted. A point that merits attention - though it requires following the links above to observe - is that these RFCC difficulties typically occur in a single unit or section of a much larger refinery, where they are then contained. This explains why refineries generally appear to resume operations with remarkable speed following RFCC fires or other incidents. The South Korean RFCC fire occurred at its “No. 2” unit. The existence of a No. 2 unit strongly suggests the presence of a No. 1 unit and quite possibly a No. 3 as well. The Galveston Bay fire broke out in the 64,000 bpd RFCC unit, which forms part of a considerably larger 631,000 bpd refinery. Similarly, the Exxon Mobil refinery RFCC unit that experienced difficulties was situated in the 120,000 bpd unit section of a 612,000 bpd refinery. It would appear that, given the frequency of RFCC incidents, larger refineries in particular tend to anticipate such problems by incorporating contingency measures that allow difficulties to be isolated within one section of the refinery without disrupting the entire operation.

Ok, but new refineries?

Is it usual for a new refinery such as the Dangote Refinery to experience this many outages early in its operational life? The answer is both yes and no. The S&P Global presentation has already covered the Pengerang and Ruwais refineries, both of which suffered RFCC difficulties at the commencement of their operations. The Vietnamese refinery might be stretched into this category as well, having opened only in 2018 before encountering RFCC problems in early 2023.

What appears unusual about the Dangote Refinery is the frequency of these RFCC incidents. From the first S&P Global chart, we observe that the RFCC unit began testing in October 2024. The first difficulty occurred shortly thereafter in January 2025, and subsequently they became an almost monthly occurrence - two weeks off here, three weeks down there. Hence my equivocal response. Whilst it is not unheard of for new refineries to experience RFCC problems, it does seem exceptional for them to suffer this many outages.

What might be the cause of these outages? Here I must strongly remind you that I’m only an accountant and in all of documented human history, no accountant has ever built a refinery let alone run one. I have no idea what is behind the outages neither do I have any particular insight into what is going on at the refinery in Lekki.

Single Train, maybe?

The Dangote Refinery is well documented to be a “single train” refinery. But what does this mean? In plain language, this means that there is only one path to crack heavy oil i.e the RFCC. Go back to the first bullet point in the Kpler report I quoted above and you see this stated plainly - all the major units have been commissioned but the RFCC is the only deep conversion unit.

The Pengerang refinery in Malaysia mentioned earlier is a two-train RFCC refinery by design ( you can see the slide above refers to “one of two RFCCs”). We already talked about the “No. 2” RFCC at the South Korean refinery.

Perhaps more interesting is that some refineries employ alternative methods to break down heavy oils should the RFCC unit be out of service. In the section concerning the new Dos Bocas Refinery in Mexico, the Kpler report states: “Its secondary processing configuration includes a 130 kbd Delayed Coker and a 94 kbd Fluid Catalytic Cracking (FCC) unit”. This means that the coker remains capable of converting heavy oil into lighter products. Later in the same report, in the section on Bahrain’s Sitra refinery, it notes: “Bapco is expanding capacity from 267 kbd to 379 kbd by replacing older units with more efficient ones, including a new 60 kbd RHCK and 56 kbd HCK”. Here, HCK denotes hydrocracker, which employs hydrogen (recall the earlier point about this) as its catalyst. Whilst expensive, it represents an alternative should the RFCC fail.

Elsewhere, I found the expansion plans for the ADNOC Ruwais refinery from a decade ago where it explicitly stated multiple paths for cracking heavy oils including RFCC, delayed coker and hydrotreater (PDF, slide 10). Finally, our old friend Jamnagar. A fact box report by Reuters from 2009 listed a delayed coker (160,000 bpd), RFCC (200,000 bpd), hydrocracker (110,000 bpd) and hydrotreater (220,000 bpd) among the refinery’s key units. These are all options to do that tricky work of converting heavy oils to lighter fuels.

The Kpler report makes mention of a “mild hydrocracker” in relation to the Dangote Refinery and nothing else I can see as the workhorse for that job, beyond the RFCC. In other words, it has fewer options with the RFCC being a single point of failure.

What happens when there’s no RFCC?

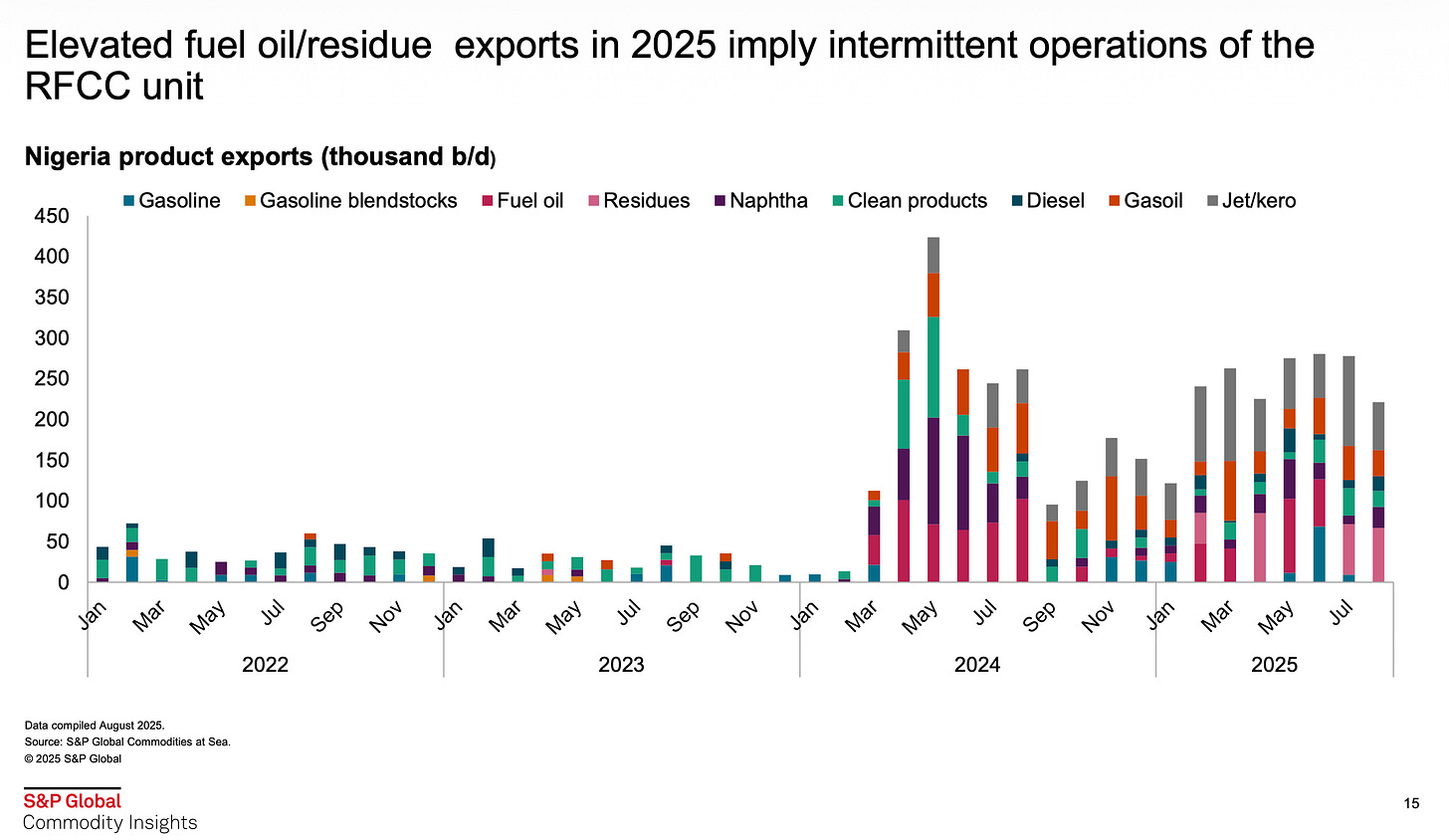

Given how critical the RFCC is to getting the useful lighter fuels out of the refinery, what can be done when it breaks down? There are a couple of things you would expect to happen. The first is that such a refinery will start exporting heavy/residue oils. Remember that the production of this type of oil happens before the RFCC. Heavy oils are not as valuable as lighter fuels as we already established but they are better than nothing. Here’s the S&P Global report saying it:

One can observe that residue exports - represented by the pink bar - increase substantially from approximately February of this year. The Dangote Refinery processes material to this stage but cannot refine it further owing to the RFCC difficulties. It is, in essence, leaving money on the table by failing to capture this value addition.

A second consequence one might anticipate when an RFCC unit is malfunctioning and the refinery lacks alternatives is that operations become confined to light, sweet varieties of crude. Fortunately for the Dangote Refinery, Nigerian crude oil satisfies this criterion of being light and sweet, though I doubt anyone could assert with confidence that NNPC is a reliable partner. The likelihood of their supplying all the Dangote Refinery’s requirements is vanishingly small, so one might examine what manner of crude the refinery is importing to compensate for the deficit. Fortunately, the nature of the international oil market is such that such matters cannot be concealed. The S&P Global report reveals the following:

Again, we see plainly that the refinery’s imports are entirely the light and sweet type. You have to do what you have to do to get by.

There is one further indication. The Kpler report contained this passing observation: “and may also import naphtha cargoes to keep gasoline production up, a strategy used previously to sustain supply”. Naphtha? What is that?

In brief, it is a type of petroleum fraction that requires purification and the improvement of its octane (think of octane as a rating that tells you how well petrol can prevent an engine knocking. Knocking is when the petrol in the car has uncontrolled mini-explosions so the higher the octane level, the more knock resistant the petrol is) levels before it can become petrol. One might think of it as raw, unrefined petrol. When crude oil is heated and allowed to separate by boiling point, the lightest gases are released first, followed by naphtha, then kerosene and jet fuel, diesel, and finally the heavier fractions. In other words, it is something from which one can produce petrol without requiring an RFCC unit. In industry terminology, what is known as “straight run naphtha” is produced during the crude distillation process (as previously discussed). A refinery can take this naphtha, purify it by removing the sulphur, separate it into light and heavy naphtha, and then blend these components to produce finished petrol that meets local market specifications.

This route works even if the RFCC is down, because naphtha is already “light.” You don’t need a resid‑cracker to make gasoline from naphtha - you need the naphtha hydrotreaters, isomerisation, and reformer. In Dangote’s case, those units are among the major systems that were commissioned early in ramp‑up and they all seem to be working fine from all indications. This represents something of a second-best solution: when the RFCC is unreliable or offline, the refinery forfeits a substantial internal source of cracked naphtha and petrol components. The next most favourable option is to import naphtha and process it through its purification and octane-enhancement units to maintain petrol production.

Conclusion

To reiterate the point made at the outset: this is not a judgement or opinion piece (there will be ample opportunity for that in due course). I have been surprised by the absence of basic information concerning what ought, I believe, to constitute a fundamental element of public education by the media. There also appears to be deliberate disinformation regarding precisely what is occurring at the refinery, even when there should be nothing to conceal (I note wearily the emergence of anonymous organisations once again, a tactic long favoured by Dangote).

Whatever one’s views may be, that refinery holds systemic importance for Nigeria and warrants rather more understanding from the general public. All I can state with confidence, as matters stand today, is that it is experiencing early-stage challenges of the sort one might expect with a new refinery of such scale - though these challenges appear unusual owing to the distinctive design choices made during construction. The refinery is thus presently operational, though perhaps not optimally so. Government policy appears to have raced ahead of all this without any assurance that the RFCC difficulties will soon be fully resolved. Alternatively, perhaps such assurances have indeed been provided to the relevant authorities, who have judged them credible.

The Kpler report anticipates the RFCC unit returning to service on 10 December. Whether that date proves accurate or not, the matter bears watching closely. For a nation whose economic fortunes remain so intimately bound to petroleum, the fate of this refinery - and the reliability of its most critical processing unit - is no trivial concern. The story, one suspects, is far from over.

This is incredibly detailed and you can't get this quality of reporting anywhere in Nigeria, well done.

I have been educated. Well done!