Playing Ostrich

Policy Discourse and the Art of Dishonesty

I am deeply frustrated when people in positions of power employ global issues to explain away domestic policy failures. This is done to avoid responsibility and is a typical occurrence in Nigeria. For years during Buhari's government, the administration constantly blamed the economy's performance on global factors such as the decrease in oil prices, the Covid-19 pandemic, and Russia's invasion of Ukraine - and did not once admit to making any domestic policy errors.

To be clear, I am not denying that these factors do have an impact. But it is particularly disturbing when the people who quickly blame global issues are technical experts who utilize their knowledge to conceal public discourse in a smoke of expertise and credentials. Such is the case with Dr. Kingsley Obiora, who was an economic adviser to the suspended CBN governor Godwin Emefiele, and was later elevated to the position of deputy governor.

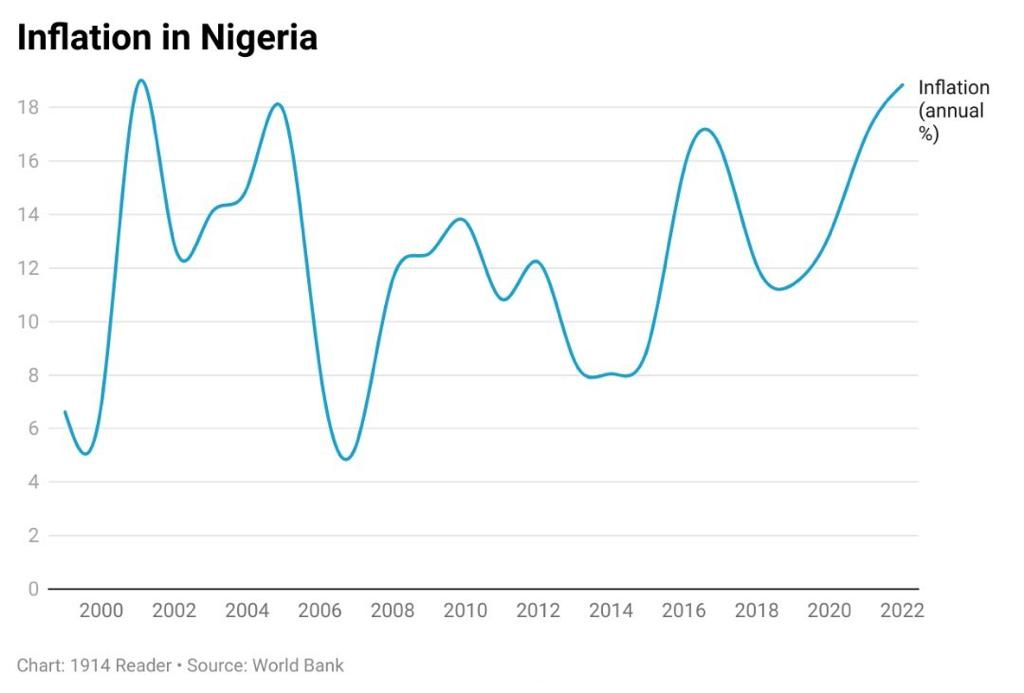

Dr. Obiora's recent paper, which has received coverage from Bloomberg, suggests that market concentration - that is, firms having dominance of their industries and thus having monopoly power over prices - could be a major cause of high inflation in Nigeria. Inflation currently stands at 24%, reaching levels not seen in about two decades, and has been a persistent issue for Nigeria. Discussions around the cause of inflation have been ongoing, with those in favor of 'supply-side' causation arguing that production-related issues, such as domestic insecurity and geopolitical events, are to blame for the price hikes. The Central Bank of Nigeria (CBN) has sided with this view, and now Dr. Obiora has added his perspective to the conversation. His research suggests that market concentration is a significant factor in inflation - and lending credence to the idea that the CBN has no powers to fight inflation through the main tools at its disposal, like the Monetary Policy Rate (MPR).

But there are also people who disagree with this view and argue that inflation in Nigeria is caused by an aggressive monetary expansion overseen by the CBN itself - and that the institution is not as powerless as it claims in the fight against inflation if only it can tame its appetite for unorthodox policies.

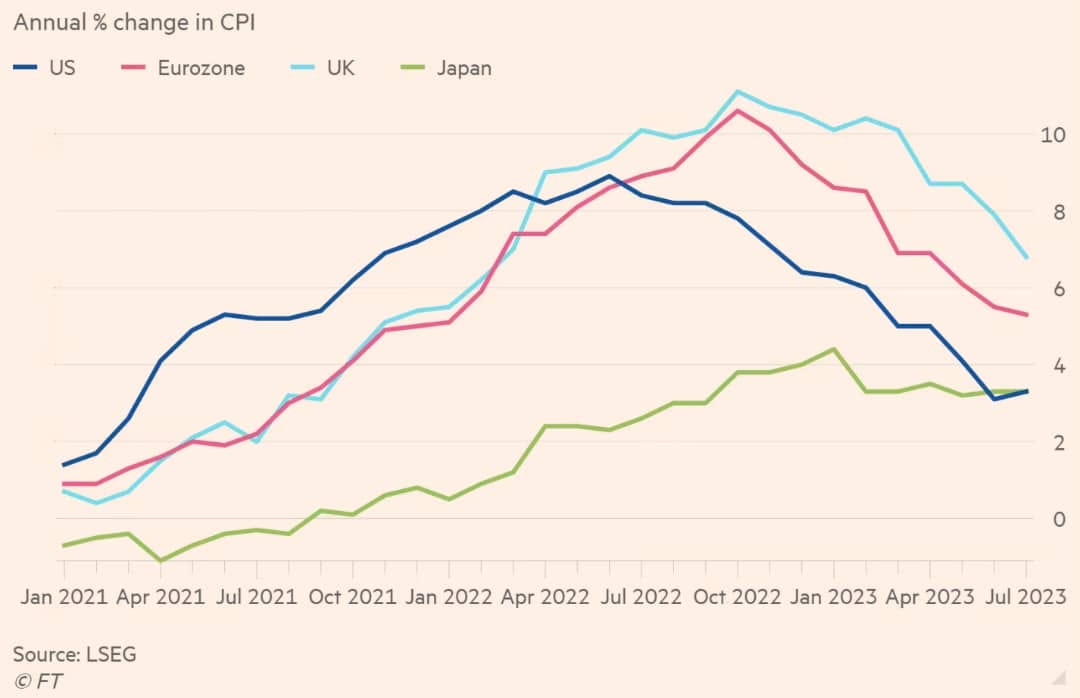

Many rich countries that have been used to low inflation for two to three decades started experiencing higher inflation rates in the aftermath of COVID-19 lockdowns and the economic disruptions they caused. It is not surprising that high inflation in countries that are used to single-digit rates of inflation will lead to vigorous debates in public discourse. It is on the back of this that three economists from the Federal Reserve Bank of Boston published a paper arguing that concentration may be a contributor to the persistence of inflation in the U.S. at the time. Their paper spun a much wider debate about the role of large firms and their thirst for high profit (Greedflation) margins in the hardship faced by households in the form of high prices. That debate is ongoing, although the recent downward shift in inflation suggests that the ''Greedflation'' hypothesis is not very convincing.

What is relevant, however, is that Dr. Obiora's paper is quite similar to the one by the Boston Fed economists - and that caused me to raise an eyebrow. To be clear, I do not think there is anything wrong with him writing a similar paper to the Boston Fed guys. Also, I think the debate about monopoly and competition is an important one to have in Nigeria. My issue with Dr. Obiora's contribution here is that his failure to engage with the other factors that could be responsible for inflation is not an honest way to frame the discussion on inflation in Nigeria. In my opinion, an honest contribution to the discussion on inflation in Nigeria, especially by a senior figure in the central bank, has to account (or control) for the role of the CBN's monetary and exchange rate policies. To transfer the debate in a broadly low-inflation economy like the U.S. to Nigeria does more to confuse than inform public policy discourse.

Economist Brian Albrecht wrote a critique of the Boston Fed paper which highlighted a point that was repeated to me by other economists about Dr. Obiora's paper. Using the market share of firms publicly traded on the stock exchange to compute concentration is incomplete at best - especially in a heavily informal economy like Nigeria. It is also not clear whether Dr. Obiora was talking about the persistence of inflation in Nigeria through history or over a recent period (the paper used data from 1990). In the case of the former, a recent IMF paper argued that the biggest factors for high inflation were monetary expansion and exchange rate instability. If what he has in mind is inflation in very recent times, then any argument in favour of concentration has to reckon with the CBN's monetary and supply-side adventures for it to be credible. For example, the same IMF paper mentioned supply shocks like the land border closure as a contributor to inflation in recent times. However, the land border closure was a policy the CBN leadership heartily supported and defended at the time. Even if we did start taking concentration seriously, it still does not remove the risk of high inflation given the failures of the CBN in its core policy function in the last seven years, and the political overreach that may have damaged its credibility in the short term.

One way to defend Dr. Obiora is to say that he is an expert exercising his right to independent scholarship - by identifying another factor contributing to inflation regardless of the other factors. This may be valid, but it is a defense that I reject for two related reasons. Firstly, Dr. Obiora has to explain what happened at the time Nigeria reached a single-digit inflation rate under better monetary and exchange rate management. This suggests that the effects of concentration is still negligible in the persistence of inflation. Secondly, if the CBN's governance and policy failures are indeed mainly responsible for the inability to tame inflation, then Dr. Obiora does not get to switch hats and lecture us - without at least being accountable for his intellectual contributions to those failures or his pushback against them.

Finally, I do think we need to take competition seriously in Nigeria. But before we sanction eager bureaucrats to go on their habitual missions of harassment, we need to know more about the dynamics of concentration in the economy. Personally, I think the honest place to start anti-trust enforcement are with firms earning political rents - that is those whose dominance is evidently through lobbying for preferential regulations.

This has been the stance of the APC-led government since they came to power. Their unwillingness to engage in any form of self-evaluation is one of their biggest issues. If you don't know what the problem is, you can never solve it. They have decided that they can never be the problem, even though they have never tendered solutions.

The more annoying thing is that their excuses are always hollow and don't hold up under any sort of examination. Case in point the examination you have made. See also, blaming PDP, covid-19 and BDCs for other economic mishaps.

Nigeria has the highest cost of living of the countries I've visited, I noticed it as far back as 2003. Inflation in Nigeria is caused by "all of the above". The solution is a more free and open economy and less government.