It’s getting hot in here

I came across a new research paper that stopped me in my tracks. Titled GDP and Temperature: Evidence on Cross-Country Response Heterogeneity, it made the following claim in its abstract:

After controlling for latitude and average temperature, positive growth responses to global temperature shocks are more likely for countries that are poorer, have experienced slower growth, are less educated (lower high school attainment), less open to trade, and more authoritarian.

Heh.

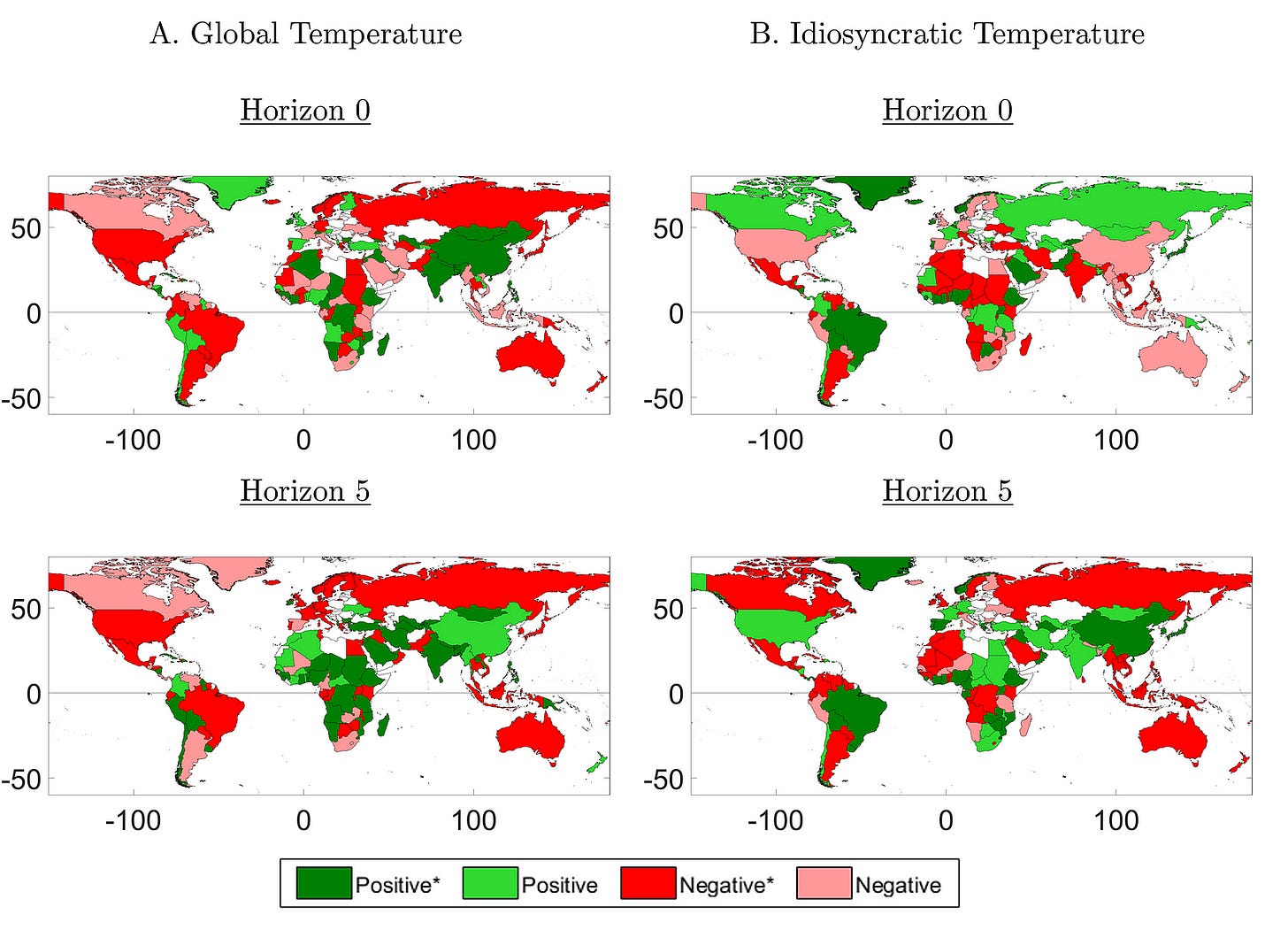

That describes Nigeria almost to a T. So you’re telling me when the world experiences extreme weather shocks, that is good news for Nigeria’s GDP? Indeed they include some maps in the paper from which you can see that Nigeria turns out ‘green’.

They go on to say:

Let us look at the response to global temperature shocks. At horizon 0, negative responses are found for both high (e.g., Denmark, South Korea, and Norway) and low (e.g., Zambia, Uganda, and Ghana) income countries. At horizon 5, negative responses are found primarily for rich countries. All of the Group of 7 (G-7) country responses are negative and of these all but Canada’s are significantly so. Surprisingly, some of the poorest countries experience significantly positive growth responses to positive global temperature shocks. This include large swaths in Sub-Saharan Africa and South Asia. Some of the larger oil producing countries in OPEC have significantly positive responses by horizon 5 such as Angola, Iran, Nigeria, Saudi Arabia, and UAE

Sensational. And I am definitely surprised as this is not something that would have been intuitive to me. What might be the mechanism at play here?

Sadly, the authors are unable to say for sure how exactly this works:

That’s a bummer. However the last paragraph may be a kind of portent of what’s to come across the world as we get to know more about the climate and the effects of all the mitigation efforts being put in place. To put it bluntly, it may not be good for some countries for climate change to be halted or reversed.

Heh.