Immobile

Was reminiscing with a friend recently at how important Nigeria used to be to Exxon Mobil, the largest privately owned oil and gas company in the world. After almost 70 years operating in Nigeria, the company is these days a shadow of its former self and every-time they’re in the news now, it’s nearly always about them selling assets or reducing their footprint in the country.

Many people dislike oil companies in general, with good reason, and the bigger the company the more reasons you can have to dislike them. But to the extent that you are going to have an oil industry at all, it is far better to have Exxon Mobil in there than not to. They have tonnes of capital, expertise and are easier (relatively) to hold accountable for things like environmental damage.

Here are a series of charts to illustrate the decline in their relationship with Nigeria:

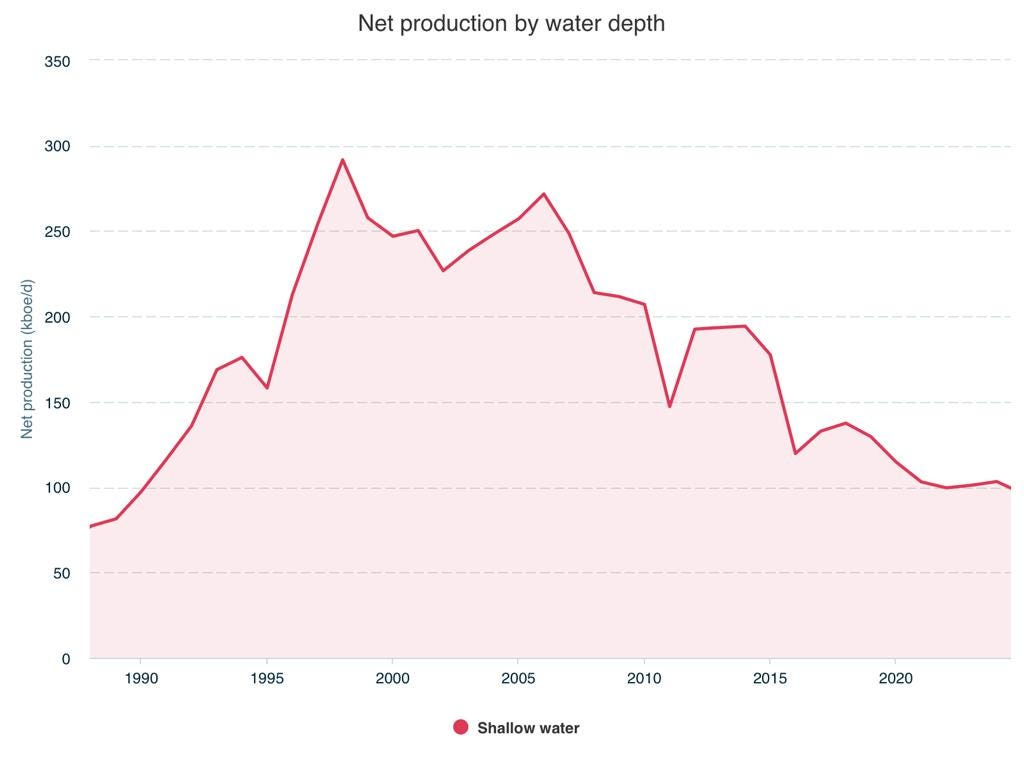

In the 1980s, production began an upward climb and continued until the late 1990s. Things remained steady for about a decade (well into the return of democracy) and then began to plunge. The result is that today, Mobil’s production is back where it was roughly around 1990.

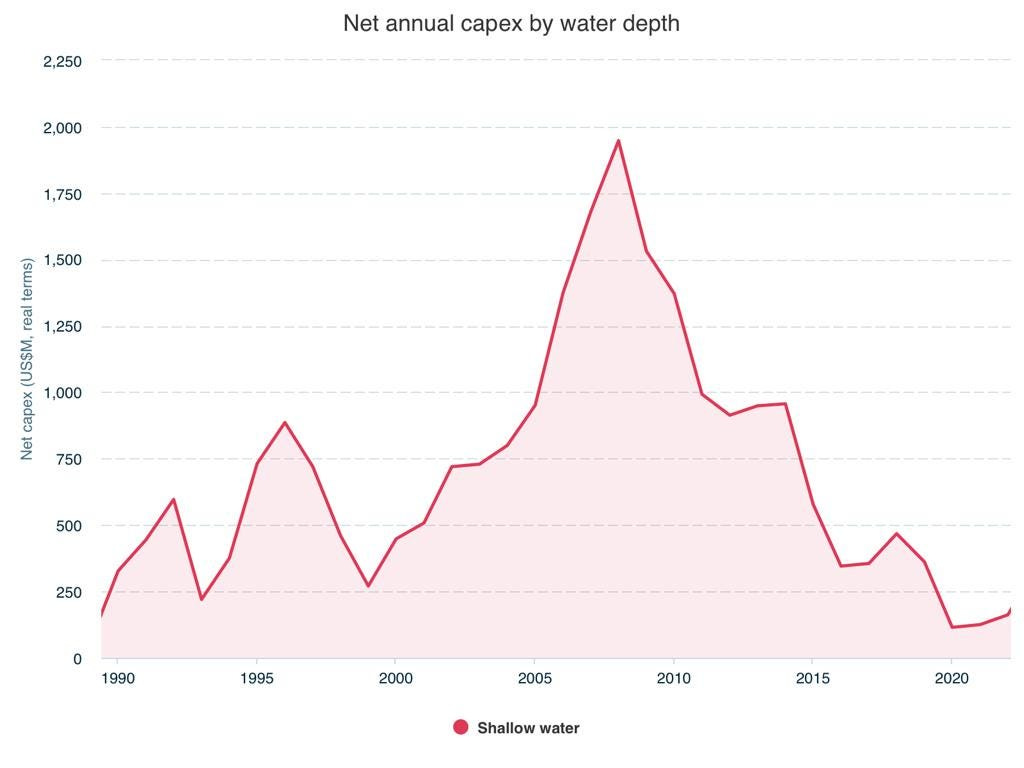

It is no surprise that capital expenditure correlates with production — oil is an incredibly capital intensive business and if you are going to get anything out of the ground, you will need to spend billions of dollars in advance. Sometime around 2009, Mobil’s capital spending in Nigeria peaked at just under $2 billion a year. From there gravity took hold and, just like with production, spending is back where it was in 1990. For sure, this is not a company that has Nigeria in its future plans. This is clearly reflected in revenues as well:

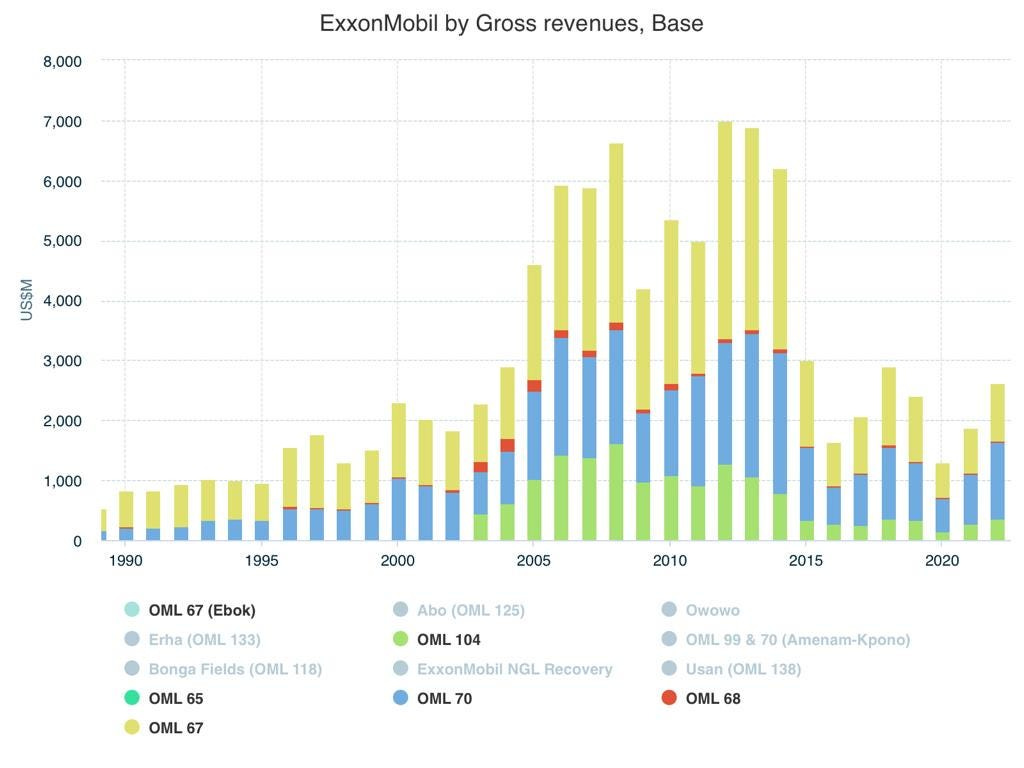

This is a nice illustration of the capital expenditure to revenue story: you can say that the investments that peaked around 2009 led to the revenues that peaked in 2012 at $7 billion. These days revenues are only about a third of that peak.

As I’ve written previously, the reasons for these trends are complex, not least that Nigeria is a ‘dirty’ country — from the point of view of Exxon Mobil’s overall portfolio — that they’d rather avoid. But these are not impossible problems to solve.

My friend (the one with whom I was reminiscing) did a back of envelope calculation as follows: 11 divested oil fields have somewhere in the region of just under 8 billion barrels of oil left under the ground in them. The fields currently do about 300,000 barrels per day oil and gas combined. Oil itself makes up about 200,000 barrels per day of that number. Given the amount of reserves in them, those assets can obviously be made to work harder and produce more.

Suppose that you wanted to double the amount of oil coming out of them to 400,000 barrels per day? This is not impossible but will require a lot of capital expenditure to make it happen. When you factor in unavoidable losses at the well-head and the natural decline as you exploit the wells over time, you will need to pump 500,000 barrels per day of oil and gas to achieve that 400,000 barrels per day target that doubles the current output.

The question then is how much investment will it take to make this kind of increase happen? Somewhere in the region of $3 billion — $5 billion spent every year for at least 4 years. That is, the best part of $20 billion in capital expenditure committed to Nigeria.

How many companies in the world are capable of spending that kind of money let alone in Nigeria? You will not be able to count 4 companies without including Exxon Mobil. And it is definitely doable for the company:

It spent more than $18 billion in 2022 and was spending double that amount a decade ago.

One of the first meetings President Bola Tinubu has held was with Exxon Mobil executives. The only irony here is that a big topic (or maybe even the only topic?) of discussion would surely have been the hold on the sale of its assets to Seplatwhich was blocked by NNPC for no good reason last year.

President Tinubu was of course once a Mobil guy himself. Maybe now that the company have their alumnus in Aso Rock, their relationship with Nigeria might start to improve and they will start spending again.

I’m not holding my breath but I will be keeping an eye out on this all the same. As a starting point, the last time Nigeria had what can be described as a credible licencing round was in… 2007.