[Guest Post] PenCom’s PenCare: When Good Intentions Threaten a Good System

A hard won regulatory reform is at risk from good intentions

We occasionally feature guest contributions that offer exceptional analytical value. This piece, written by a subject matter expert, provides valuable insight into Nigeria’s regulatory process - revealing how policy gains are won, and why they must be vigilantly defended.

In late October, Nigeria’s pension regulator, the National Pension Commission (PenCom), announced the formation of the Board of Trustees (BoT) for the Pension Industry Healthcare Initiative (PHI). The PHI, also known as PenCare, is a new program - the brainchild of PenCom’s Director-General, Omolola Oloworaran - which seeks to provide affordable and quality healthcare coverage to retirees under the Contributory Pension Scheme (CPS).

Under the initiative, the BoT - chaired by pioneer PenCom DG Mohammed Kabir Ahmad - is to develop a framework for accrediting healthcare providers, supervising HMOs, and providing free or subsidised health insurance for “low-income” retirees. By all appearances, PenCare looks like a benevolent welfare initiative - a noble effort to safeguard retirees’ dignity and welfare in a country where affordable healthcare remains elusive. However, behind the rhetoric lies a more troubling reality: PenCare represents a policy overreach that could fundamentally distort the logic of Nigeria’s contributory pension system.

A welfare initiative funded by Contributors

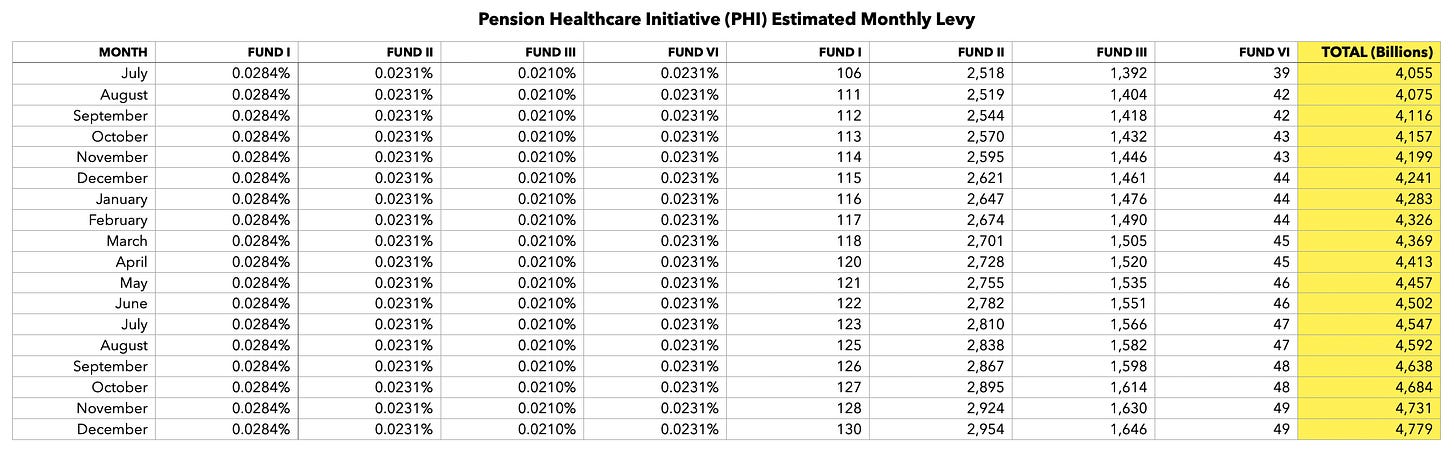

In July 2025, PenCom revised the pension industry’s fee structure, increasing total management charges across all Retirement Savings Account (RSA) funds. This revision included a new “Pension Healthcare Initiative (PHI) fee” of 0.021% to 0.028% of assets under management, applied to specific industry funds. With the industry’s current assets under management at N25.7 trillion, this new fee is projected to generate approximately N4 billion monthly, assuming a modest 1% monthly growth in AUM. The table below shows estimated PHI fee collections for 18 months beginning July 2025, when PenCom began collecting the levy.

Given the age profile of retirees, we can expect these levies to rise in future as the demand for healthcare rises. To reinforce alignment, PenCom simultaneously raised its own supervisory fee by 50%, alongside proportionate increases for Pension Fund Administrators (PFAs) and Pension Fund Custodians (PFCs).

While PenCom’s press releases describe PenCare as a “joint industry initiative,” the facts tell a different story. The funding does not come from operators or the regulator, but from contributors’ assets, via higher fees collected by PFAs and PFCs. In effect, pension contributors are paying for a healthcare scheme they neither requested nor may ever benefit from.

This is not partnership but a regulatory levy disguised as benevolence. More critically, by using contributor-derived fees to fund healthcare for current retirees, PenCom is reintroducing value transfers into a system designed precisely to avoid them. Current workers are now indirectly subsidising retirees through a non-statutory levy - precisely the kind of moral hazard the CPS was created to eliminate.

Undermining the contributory logic

Before the 2004 pension reforms, Nigeria operated a Defined Benefit (DB), pay-as-you-go (PAYG) system where retiree benefits were funded by active workers and government allocations. That model became fiscally unsustainable - a kind of intergenerational pyramid that collapsed under the weight of poor governance and mounting arrears.

The CPS replaced that with a funded, privately managed, and transparent model anchored on individual capitalisation. Each worker’s savings are owned by them, accumulated over time, and protected from the intergenerational liabilities that doomed the DB system.

PenCare, however well-intentioned, undermines this architecture. By imposing a contributor-financed levy to fund retiree healthcare, PenCom risks eroding the trust that underpins the CPS - the assurance that every naira saved belongs solely to the saver, not to a shared welfare pool.

No statutory basis, No board oversight

Beyond its philosophical inconsistency, PenCare lacks any explicit legal foundation. Nothing in the Pension Reform Act (PRA) 2014 authorises PenCom to establish or fund a healthcare program.

PenCom’s involvement as both regulator and funder/operator blurs the line between policy oversight and commercial activity. The regulator’s statutory duty is to supervise, not to co-finance, industry initiatives. By directly managing a healthcare scheme, PenCom is now both referee and player, undermining regulatory neutrality and creating potential conflicts of interest.

Equally troubling is the governance vacuum. Since 2023, PenCom has operated without a duly constituted Board of Commissioners, despite the PRA vesting all policy, budgetary, and financial approvals in that Board (Section 17). Although President Tinubu has since announced new nominees, the DG appears determined to proceed with the PenCare rollout even before Board oversight is restored. On what authority was this initiative approved? Was a legal opinion issued by PenCom’s Company Secretary affirming its legality? Was the National Assembly consulted, given that the PHI fee constitutes a quasi-fiscal levy on contributors?

If contributors were to mount a class action against the PHI, one wonders what legal justification the Commission would offer for imposing such a deduction in the absence of a statutory provision or Board authorisation.

Mission creep and mandate duplication

Nigeria already has the National Health Insurance Authority (NHIA), whose mandate includes extending affordable healthcare to all citizens - including retirees. PenCare therefore risks duplicating existing functions, fragmenting accountability, and creating inter-agency overlap.

If the government genuinely wishes to provide subsidised healthcare to retirees - and it should - the appropriate vehicle is through fiscal channels, via budgetary allocation or NHIA-led coordination, not through a regulatory tax on contributors’ savings.

A cautionary note

PenCare’s vision - to give retirees access to healthcare - is noble. Its method, however, is neither lawful, transparent, nor consistent with the spirit of the CPS. By imposing an intergenerational transfer funded through contributor fees, PenCom has ventured into fiscal territory without statutory authority or governance structure to sustain it.

Such measures erode the system’s integrity, distort incentives, and undermine confidence. It may appear a small fee today, but the precedent - that PenCom can divert contributor funds toward social spending via fee increments - is profoundly dangerous.

By using contributor-derived fees to fund retiree healthcare, PenCom is reintroducing a soft version of the discredited PAYG system through the back door - a transfer without representation or consent. Contributors bear costs for benefits they may never receive, while the regulator assumes a quasi-fiscal role outside its legal remit.

It is not too late for course correction. A credible path forward would be to:

Retain the individual capitalisation principle at the core of the CPS and avoid embedding healthcare subsidies within it;

Restore proper governance oversight by reconstituting PenCom’s Board and allowing it to review and approve the PHI framework; and

It is particularly striking that the DG has chosen to enlist Mr. M. K. Ahmad, the pioneer Director-General who once defended the CPS against multiple attempts to revert to defined-benefit arrangements. Ironically, he now appears repackaged as a sort of executioner for a misguided effort to reintroduce DB-style transfers within the very contributory framework he helped to build.

Until these issues are addressed, PenCare will stand as a cautionary tale - of how a regulator’s good intentions, unmoored from law and principle, can erode the very system it was created to safeguard.

The author is very generous and appears to give way too much benefit to the purported intentions of this scam. I fail to see the “good intentions”. It cannot be a good intention if one is acting way beyond one’s remit.

If PenCom decided to fund all motherless babies and almajiri homes in Nigeria, would it be seen as a good intention?

PenCom is a creature of law that sets out its core functions. Any intentions outside this is suspect at best. In reality, this is just an elaborate scam and any healthcare that comes out of it is very likely incidental.

"Until these issues are addressed, PenCare will stand as a cautionary tale - of how a regulator’s good intentions, unmoored from law and principle, can erode the very system it was created to safeguard."

Sums up the distaster-class that's called policy in this country. From agriculture to ISI to you-name-it. Everybody just doing anyhow. Smh.