Can Venture Capital save Nigeria?

The most important lesson from Olumide Soyombo's memoir is not the obvious one

In 1608, a bunch of religious weirdos fled England for a better life in Holland. Having first landed in Amsterdam, they eventually made their way inland to the town of Leiden. These days, Leiden is a town of just over 120,000 people where the aircraft making giant Airbus has its registered headquarters. Back then, though, those weirdos were fleeing religious persecution in England (after quitting the Church of England, which was illegal to do at the time) but it did not take too long for them to find new problems in Holland. While they had achieved their original goal, they found they had to work a lot harder in Holland to survive with hard labour in the clothes making industry being the only employment options available to them. Once more, relocation became the solution to their problems. But to where? The ‘New World’ - today’s America - held out much promise and after receiving permission from the Crown in England, they set out to raise money from investors to finance the trip. What might be called a ‘term sheet’ today was written up with anyone of the Pilgrims - as they would come to be known - willing to go out there to set up getting 1 share and any investor willing to pay £10 also getting one share. It took a lot of haggling and disputes for the deal to be finalised but, after some mishaps with the first ship, the Pilgrims (102 of them with more than half not being church members) set out for America in September 1620, on a ship now famously known as The Mayflower, to begin a life with more unknowns than knowns.

They were not the first to try setting up on America’s east coast but the reason they so easily got permission to go there was because of how incredibly difficult it had been for those who had tried before them. The first waves of men had been struck down by diseases, famine, bitter cold and Indians and all the investors who backed them had lost their money and refused to sign up for any follow on investments. So when the religious weirdos decided to ask permission, the Virginia Company (which owned the licences) simply said: be my guest. Initially they did not fare much better - several of them died from disease and the winter was bitterly cold but they got a break by being able to develop a relationship with the Indians. Ultimately it proved impossible for the investors - ‘adventure capitalists’ - to make a return on their investments and after several rounds of negotiations, they struck a deal where the Pilgrims (under the Colony they had set up) bought out their investors for £1,800, payable in 9 annual instalments of £200 starting in 1628.

Venture Capital (VC) has many origin stories but this one is my favourite. The promise of VC is that you can obtain funding for an idea so wild and improbable that if it comes good, you can quite literally build a new country in the bargain as the Pilgrims ended up doing. Even better, none of the direct descendants of the Pilgrims can be said to ‘own’ America or even the states they helped build out today i.e. the thing you build can be so great that you can get stupendously rich (as the VC or entrepreneur) even from owning only a tiny fraction of the value created.

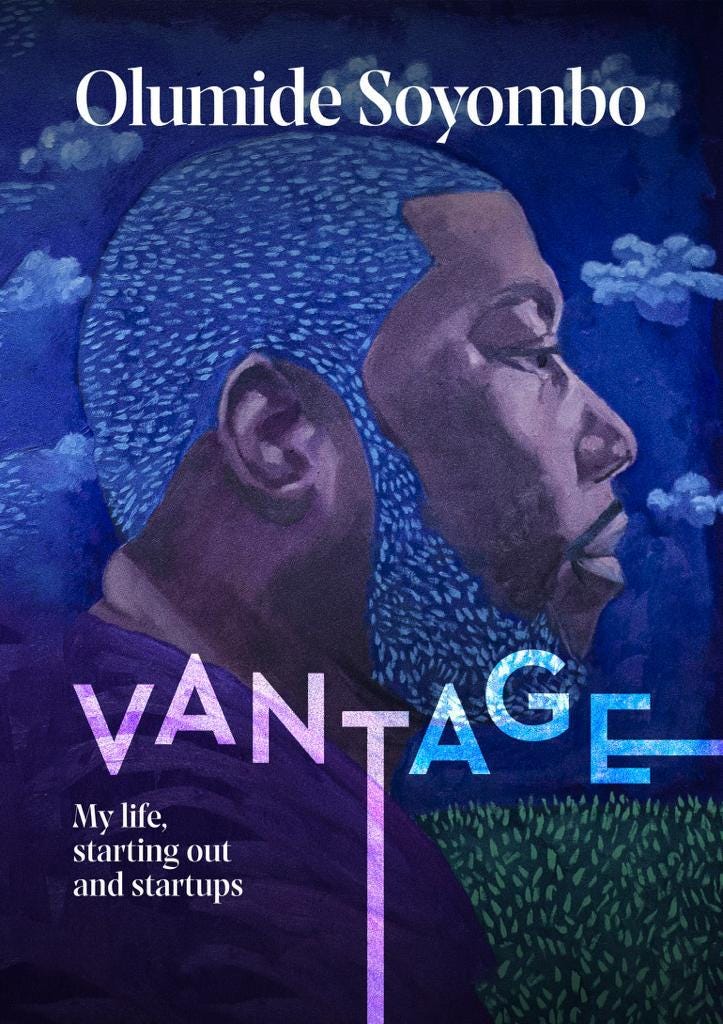

The origins of VC in Nigeria will hopefully be written one day and when it is, Olumide Soyombo’s name is sure to feature prominently in the stories of the technology startups that have helped to open up the country to the kind of entrepreneurship and capital that may otherwise have safely avoided it [Disclosure: I’m an investor in his fund]. Getting ahead of that, Mr. Soyombo has penned his own memoirs sharing the story of his life from birth to present day (he turned 40 this month). In Vantage: My life, starting out and startups, he writes about family, faith and friendships that all intersect to produce one of Nigeria’s most famous early-stage technology investors who has backed the biggest stories in Nigeria’s nascent tech startup scene from Paystack to PiggyVest and Moniepoint. From this vantage point, he has accumulated a series of stories and lessons that will resonate with a fairly broad range of Nigerians. What makes a good founder? He shares stories of founders he backed sometimes for the quality of the idea but more often for their credibility, technical chops and tenacity of the character behind the founder. Often those qualities were present in a founder and the investment still went to zero but it is hard to find investments that paid off without those qualities being present. Equally important - given that most VC investments will fail - what kind of founder is to be avoided? Sadly this is often only apparent after the fact when the founder has behaved badly and squandered investors funds (he hints at a founder who spent 3 months living in a 5 star hotel in a foreign country in the name of ‘market research’ paid for with investors funds). The lesson to be taken from the book on bad actors is that they ought to be named and shamed very publicly especially as hardly a week goes by now without a story of a founder behaving badly making the news. He does tell the story of Olumide Olusanya who raised $765,000 from investors for a cloud commerce idea and now has a warm case file at Nigeria’s Economic and Financial Crimes Commission (EFCC). A memoir is probably not the place for calling people out but investors in Nigeria’s tech startup scene should at least know that there is often a lot that is whispered around and not visible to the ordinary eye.

Nigeria remains a country where merit comes a distant second to relationships when it comes to making a way for yourself. This is hardly unique to the country with China’s well studied guanxi (关系) being an example of the kind of baseline you have to contend with in that society. But relationships are not the whole story and what this book shows is just how you can work them to your advantage in building influence and accumulating wealth (Mr. Soyombo is by his own account now a very wealthy man - the numbers get bigger as you go through the book). Here is a passage about how important relationships are when you’re an early-stage investor:

At the early stage you’re opening doors for the company, introducing them to the corporate world, solving regulatory issues, etc. I know how many times I have had to make a foray into regulatory agencies to help a company; a foreign investor is not going to do that. Foreign investors might bring capital, but they are not going to introduce you to the CIO or CMO of a Nigerian telco. Sometimes those introductions are partnerships that are even worth more than any amount of cash

This sounds fairly innocuous and is hardly different from what you will find in most other countries. But in a country like Nigeria where you simply cannot rely on any sort of baseline behaviour from regulators (they could be decent, mad or downright evil), it is an incredible advantage to have and difficult to compete with. There is thus a way in which the book can be read as a series of relationships and how he views them. He takes a long term view to most relationships described and coupled with his other (admirable) qualities as a social person, the relationships often end up greater than the sum of their parts. There are relationships with bank executives, founders, wealthy people with old money and intergenerational relationships with people much older than himself - the description of his relationship with the much older Richard Lewis is particularly affectionate. His relationship with his cofounder of Bluechip Technologies, Kazeem Tewogbade, can be read as a template for how cofounders can complement each other’s talents when building a business in which daily friction is guaranteed.

There is much else in the book covering reading habits, art collection and non-tech investment experiments in nightclubs and a hodgepodge of other experiences. There is advice to be respectful, dress appropriately and to socialise if you have dreams of selling in Nigeria, all things the author himself can be seen to live by. There is also a counterfactual discussion of the roads not travelled: what if he had gotten the job he wanted in the UK and stayed in the country instead of returning to Nigeria? Nigeria being what it is means that it is difficult to share the full story of any kind of success so there are the inevitable gaps in the storytelling such as the rather consequential passage below:

In 2007 I returned to Nigeria and interned at Skye Bank while waiting for NYSC. Dad and the owners of the bank were partners in other ventures and a distinction in my master’s helped me get the internship. From there I got a job with Tavia Technologies. They won a bid to build a data warehouse for Access Bank in 2007. It was there I would meet the partner with whom I would start Bluechip Technologies in 2008.

But what can be gleaned from the book is the unique perspective of someone who himself began as an entrepreneur, built a successful business which now does $60 million in annual revenues and became a backer of startups (while still running his own business). He shares a number of stories of spotting opportunities as they emerged and having the courage to move quickly to seize them ahead of others. The story of how his tech company, flush with cash, decided to begin taking bets on Nigerian tech startups, well ahead of the curve, is incomplete in the book - is betting on startups really a way to manage risk in a profitable company as he suggests? - but given how correct it has proven, he should be taken seriously as someone who sees trends before most other people do. More often than not, what you get is one or the other - entrepreneur or investor - in one individual especially as an economy develops. It is thus not a surprise to find large investment companies in western societies specifically recruit people who have entrepreneurial experience as investors to aid the deployment of their capital. To have done both successfully, in Nigeria no less, is the vantage of all vantages.

The biggest lesson from the book, however, is in where his story intersects with that of Nigeria and, perhaps unwittingly, offers a sharp contrast with the social makeup of the country. Several years ago, a chance conversation prompted me to carry out a survey of my friends to test for what Melissa Kearney calls in her new book the Two-Parent Privilege. I was very surprised to find that the number of my friends who grew up in a home with two parents were in the minority. This is not intuitive at all in a country like Nigeria that talks big on religion and traditional values. I became less surprised when I started doing a daily newspaper review of Nigerian newspapers and was confronted with the sheer scale of social disintegration in Nigerian society. To put it bluntly, Nigeria social’s fabric has been torn asunder. Readers of 1914 will know that I send out a weekly review of Nigerian papers these days and I can only say that I make a point not to share 90% of the stuff I come across. It is not uncommon, for example, to come across stories of children murdering their parents over a relatively small amount of money or even more darkly, money rituals. Families break down for the flimsiest of reasons just as they come together seemingly to do nothing other than have children.

Going through the book and observing the relationship between Soyombo pere and Soyombo fils, and as someone who has written about his own daddy issues, I couldn’t help but wonder how much better a country Nigeria would be if the country had more… Dads. Those who have it can easily take it for granted and assume it is the same for everyone else. I can’t blame them as what they have is, and should be, the norm. Here is one of many lines acknowledging the role his father played in underwriting his life:

With Dad being an ever present, and at times assertive mentor, failure looked unlikely because we took his counsel seriously, and we adjusted immediately.

He writes about many instances of his father stepping in to lend a hand with cash, advice or both. It is also plain to see that he took his father’s counsel seriously because of the power of the personal example he set as a dad. When his mother was diagnosed with a terminal illness in 2007 and lived under the weight of it for 15 years before she passed, to much sadness, in 2022, he wrote of his father that ‘despite the pain he was clearly going through on account of Mum’s health. Dad helped to put things in perspective.’ To the very end, after his mother had passed, he writes very fondly about his father. It is priceless to have a father who is present and can lead with words and the power of personal example.

As someone who is overexposed to the very serious issues facing Nigeria, there is a limit to how optimistic I can be about the country’s future. Nigeria is a very badly governed place where leadership is under almost no pressure to challenge itself and do better. It has an army of energetic young men with nothing more than time on their hands, available to do mischief at a moment’s notice. Living a sane and normal life requires exerting an incredible amount of effort to ward off the craziness the country throws at you on a daily basis.

Can venture capital save Nigeria? I think it can. But it requires several steps to get there. The lesson from Vantage is just how much of a role having a tight social fabric can play in building people who have a realistic chance of repaying the investments in them. Nigeria could do with a lot more Olumide Soyombos either as an entrepreneur or investor or both.

It can be easy to get caught up in the idea that Nigeria needs better policies, less corruption, better leaders, better education and more economic growth as the fixes to the country. All of these things are true and badly needed. And yet maybe all of these can be simplified into one need - Nigeria needs more dads. That is, fathers to be present to guide and support the children they bring into the world and ensure they can contribute meaningfully to Nigeria.

On top of those children, a new country can be constructed.

Could never have imagined from the first paragraph that the article would wind up with the case for having good Dads in Nigeria.

Beautiful write-up.

A brilliant review. One of the things I’ve wondered reading through the book is if things lack recognizing opportunities can actually be learnt late on. Can one learn to less reserved and to take more risks? Overall, Olumide’s story and the lessons are so brilliant.

On dads, it is obviously not enough to be present but also with intent which is what I see in how his dad ran with the boys.