Another F.O.O.D Basket: Urea Case Study

Why?

Let’s begin with two definitive statements:

Gas is urea and urea is gas

The price of gas is the price of urea

By the end of this piece, I hope that the argument is sufficiently made for why those statements are true and why the link is so tight. But as with most articles I write here, we start with a story.

From Air to Food

In 1898, the renowned scientist Sir William Crookes declared that “civilised nations stand in deadly peril of not having enough to eat.” Europe’s farms could not keep up with its booming population and changing appetites because of a specific crisis: a shortage of nitrogen fertiliser. Manure and imported nitrates were inadequate, and the abundant nitrogen in the air remained out of reach. Crookes, in his role as President of the British Association, was therefore issuing a urgent challenge to his fellow scientists: find a way to pull nitrogen from the atmosphere to avert disaster.

In Germany, the challenge was taken up by Fritz Haber, a restless and ambitious chemist. With his assistant, Robert Le Rossignol, an expert in building high-pressure equipment, Haber began experimenting in a small laboratory. After testing various methods, they discovered that applying intense heat and pressure could trigger a reaction between atmospheric nitrogen and hydrogen, producing ammonia. This was the first time the process had been achieved in a practical way. In the summer of 1909, they successfully demonstrated a machine that produced a continuous stream of liquid ammonia - about a teacupful per hour. This small but steady output was the crucial proof that fertiliser could literally be made from air. The German chemical giant BASF recognised the breakthrough, acquired the process, and committed to scaling it up.

At BASF, the chemical engineer Carl Bosch went about solving the problem of turning Haber’s contraption into an industrial process. This was the equivalent of inventing a whole new type of engineering because while Haber had used some rare metals in his process, BASF needed to find catalysts that it could actually buy in large quantities. After thousands of trials, they settled on an iron-based catalyst that was tough, cheap and good enough for the job. The second problem was finding steel that wouldn’t crack under the intense heat and pressure of the process. His solution to this problem would win him a Nobel Prize in Chemistry in 1931. Once these were done, the third and final problem to solve was a large integrated plant that could handle pure nitrogen (separated from the air), huge amounts of hydrogen and gigantic compressors. In 1913, BASF built the first ammonia plant in a town called Oppau (engineering is hard and in 1921, the Oppau plant suffered a massive explosion that killed up to 600 people.) This process of producing ammonia is what we know today as the Haber-Bosch process, in honour of the two men who did so much to bring it to life.

The reliable production of ammonia made the next breakthrough possible: the synthesis of urea, which is today’s dominant nitrogen fertiliser. In 1922, Carl Bosch and his BASF colleague, Wilhelm Meiser, patented the standard method, which involves reacting ammonia with carbon dioxide. This first forms an intermediate compound, ammonium carbamate, which is then dehydrated to yield urea and water, while any unreacted gases are recycled. BASF commissioned the first urea plant that same year in Ludwigshafen, and this method remains the fundamental process used worldwide till today. If you have nothing better to do with your time, you can read the original patent here.

The role of gas

Ok so we have established the story of urea. Where does gas come in? Natural gas is the fundamental pillar of modern urea production, serving as its primary ingredient and its primary power source. In the production process, gas is essential for creating the hydrogen and capturing the carbon dioxide needed for the chemical reaction. Further, the immense heat and power required to run the industrial plant are almost entirely supplied by burning natural gas. This deep dependency directly dictates cost; since producing one tonne of urea consumes vast quantities of gas, the price of urea is inextricably linked to the price of its foundational resource. Hence the two definitive statements we opened this piece with. If the price of gas rises, the price of urea also rises - no ifs, no buts.

Urea’s primary importance lies in its role as the workhorse of nitrogen fertilisers, accounting for the majority of its global use. Containing 46% nitrogen, it is the most concentrated and efficient way to deliver this essential nutrient to crops. This directly supports global food security, as the nitrogen from urea is fundamental for plant growth and protein synthesis. It ultimately finds its way into our food, from the grains in our bread to the animal feed that produces meat, milk, and eggs. It is a cornerstone of modern civilisation, central to feeding the global population.

Nigeria enters the Group Chat

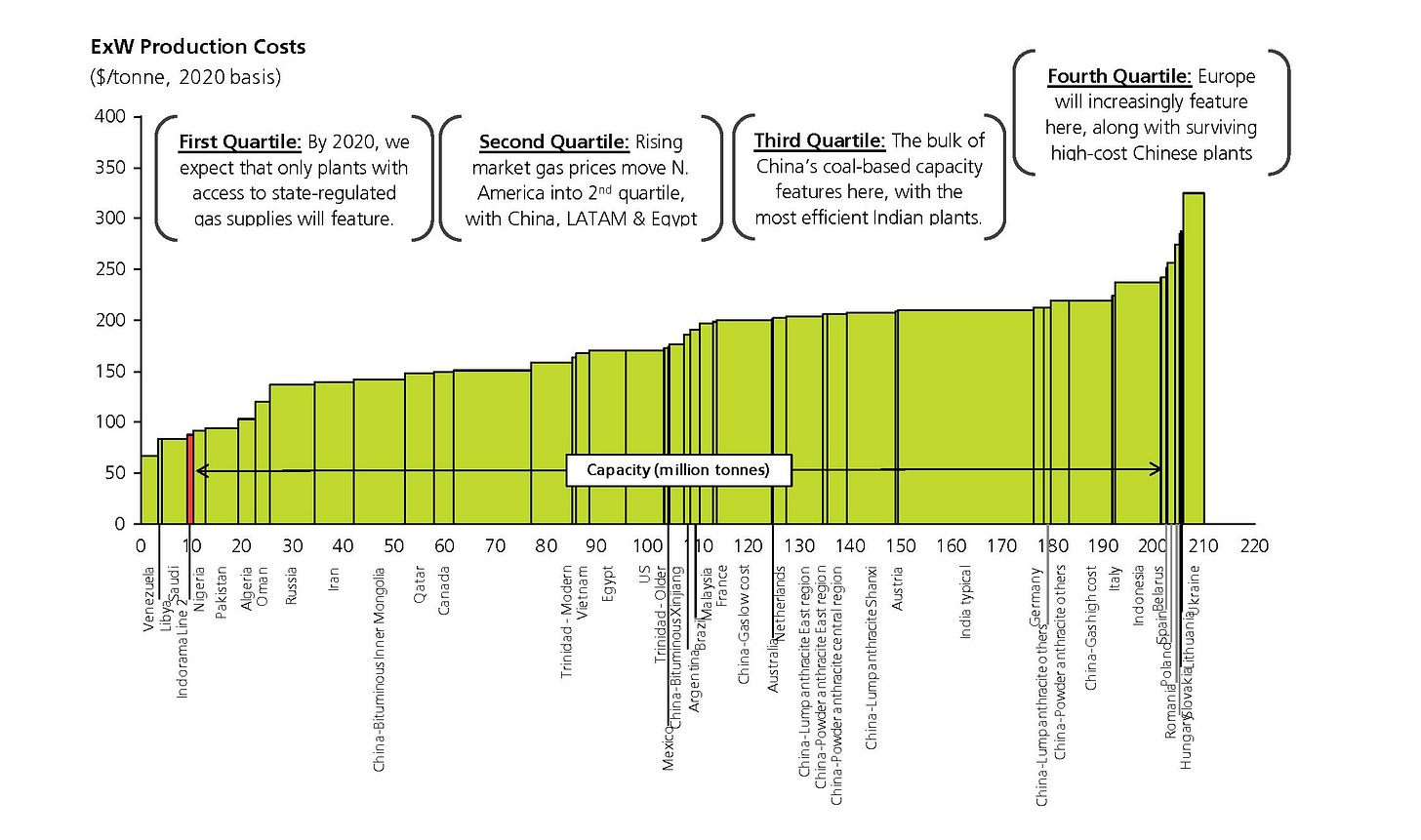

By now you’re familiar with the theme of outsourced innovation and domesticated rent-seeking I have been banging on about in this parish. Consider the chart below (shared with me from an Argus report):

This chart provides a snapshot of the global urea fertiliser production landscape, ranking the cost of production for different manufacturers around the world. It organises these producers from the cheapest on the left to the most expensive on the right, dividing them into four cost categories, or quartiles. The central message is that access to cheap natural gas is the single most important factor determining a producer’s competitive position. The red line on the left - if you squint a little - represents Nigeria. In other words, only Venezuela, Libya and Saudi Arabia are currently able to produce the stuff cheaper than Nigeria. How come? This leads us to the second part of this particular F.O.O.D story

Nigerian gas pricing

Nigeria’s Petroleum Industry Act (PIA) (PDF, Section 167) introduced something called Gas Based Industries (GBI). As the term suggests, GBIs use natural gas as a primary raw material or feedstock. Since fertiliser production relies heavily on gas, companies like Indorama, Notore and Dangote Fertiliser fall under the GBI category. This designation is significant, as GBIs are explicitly listed as one of three “strategic sectors” in the PIA, alongside power and commercial users. When an industry is singled out as “strategic,” it naturally follows that it is subject to a set of “special” terms and conditions.

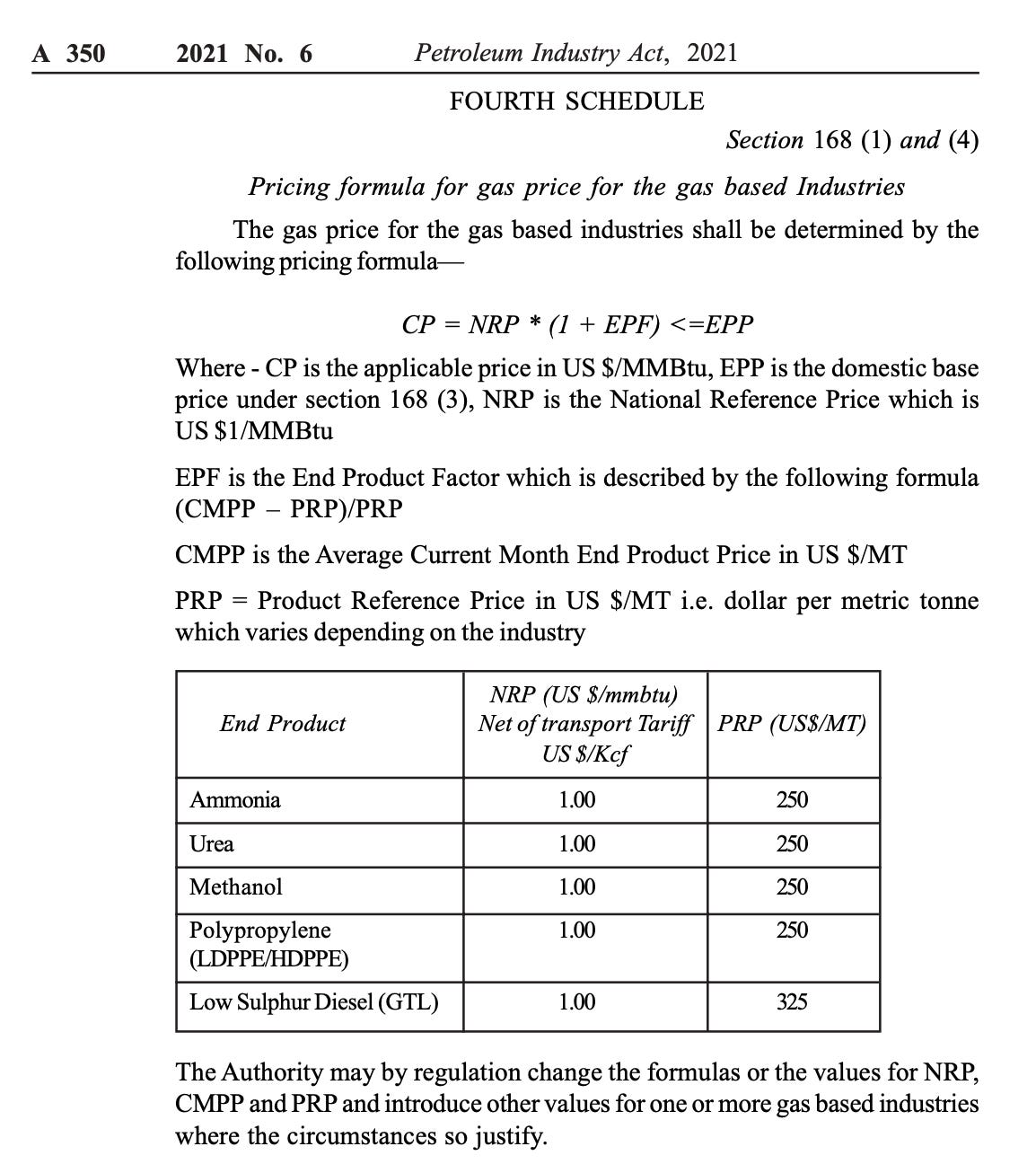

In this instance, the “special” terms are defined by the Domestic Gas Pricing Framework (DGPF). Section 168 (2) of the PIA establishes a price floor for gas supplied to these industries at US$0.90 per MMBtu. The subsequent subsection, 168 (3), sets the ceiling price at the annually determined “domestic base price.” The formula for calculating this yearly base price is provided later in the document, a excerpt of which is included below:

What does this all mean? The floor price is straightforward enough - that is the lowest price gas can be sold to GBIs under this pricing framework. The ceiling price is calculated yearly i.e. the highest possible price the GBIs can pay for gas. For 2024, the NMDPRA (their name is too ridiculous for me to type out) calculated the ceiling price as US$2.42 per MMBtu (roughly, 1 MMBtu can heat a home in winter for up to 12 hours). In other words, GBIs are currently paying somewhere in between US$0.90 and US$2.42 per MMBtu. The GBIs pay for their gas monthly so each month’s actual price is somewhere within that band.

The specific monthly price is determined by the international price of urea, using the provided formula. Imagine the global market price for urea in a given month is US $350 per tonne (this is a typical price.) The first step is to calculate the End Product Factor (EPF), which is (Current Market Price - Reference Price) / Reference Price. Using the reference price (PRP) of US$250 from the table, the calculation is (350 - 250) / 250, resulting in an EPF of 0.60.

This EPF is then used to calculate the monthly gas price (CP) with the formula: National Reference Price (NRP) x (1 + EPF). With an NRP of US$1 for urea as seen in the table above, the gas price becomes 1 x (1 + 0.60) = US $1.60 per MMBtu. This result falls safely within the annual band. However, the ceiling price acts as a crucial cap. Even if soaring urea prices pushed the calculated cost above US$2.42, GBIs would never pay more than that predetermined maximum.

International comparison

Now that we know what GBIs in Nigeria pay, we have to compare with global prices to see how much the “subsidy” they enjoy in Nigeria is worth. After all, every MMBtu of gas that is sold domestically to GBIs at a price lower than the market price is a loss of revenue.

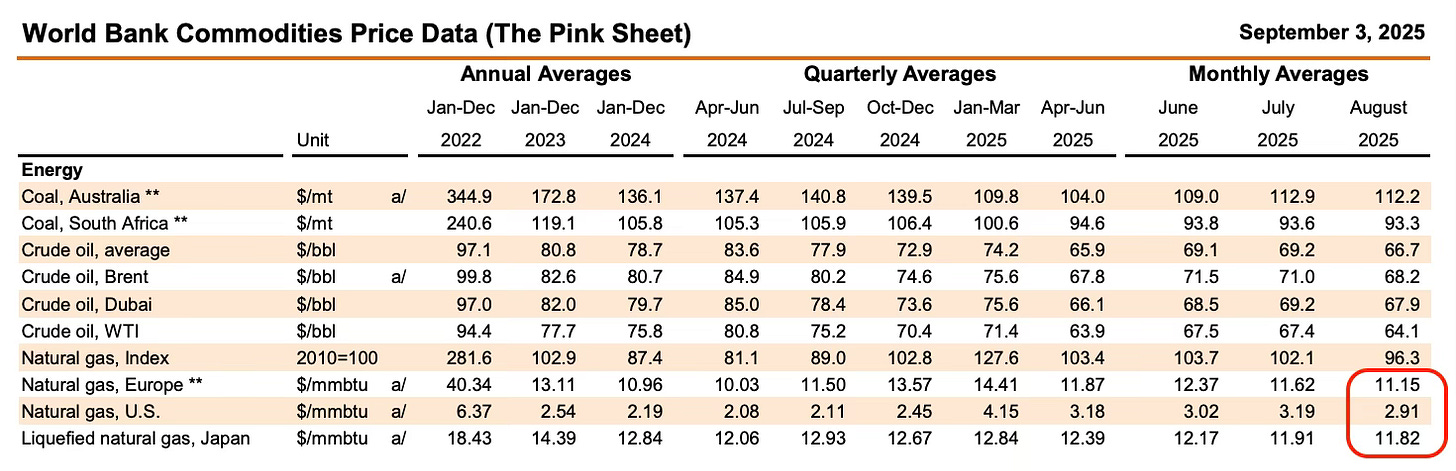

The nature of gas is that markets are regional with different prices for each. So we will compare with the US, Europe and Asia. To do that we go to something called the World Bank “Pink Sheet” which publishes average prices monthly. Here is the relevant section for August 2025:

We see that even in energy rich and gas abundant US, prices are above the cap in Nigeria, never mind the actual monthly price. In Europe and Asia, the prices are multiples of what GBIs in Nigeria pay. You can start to bring your plates out - F.O.O.D is almost ready as we start to understand why Nigeria occupied the far left corner of the first chart above as one of the lowest cost producers in the world.

What do Nigerians “enjoy”?

The fundamental link between natural gas and urea production, as we saw earlier, was forged to solve a singular, critical challenge: ensuring the world could produce enough food. This historical purpose gives powerful weight to the argument for subsidising gas for fertiliser production in a country like Nigeria. With its terrible nutrient-depleted soils and a vast population of hundreds of millions - including many living in poverty - securing an affordable, domestic supply of fertiliser is not merely an economic matter, but a foundational issue of national food security. Given this context, it becomes difficult to argue against this policy that ostensibly supports the creation of a resource so essential for feeding the nation.

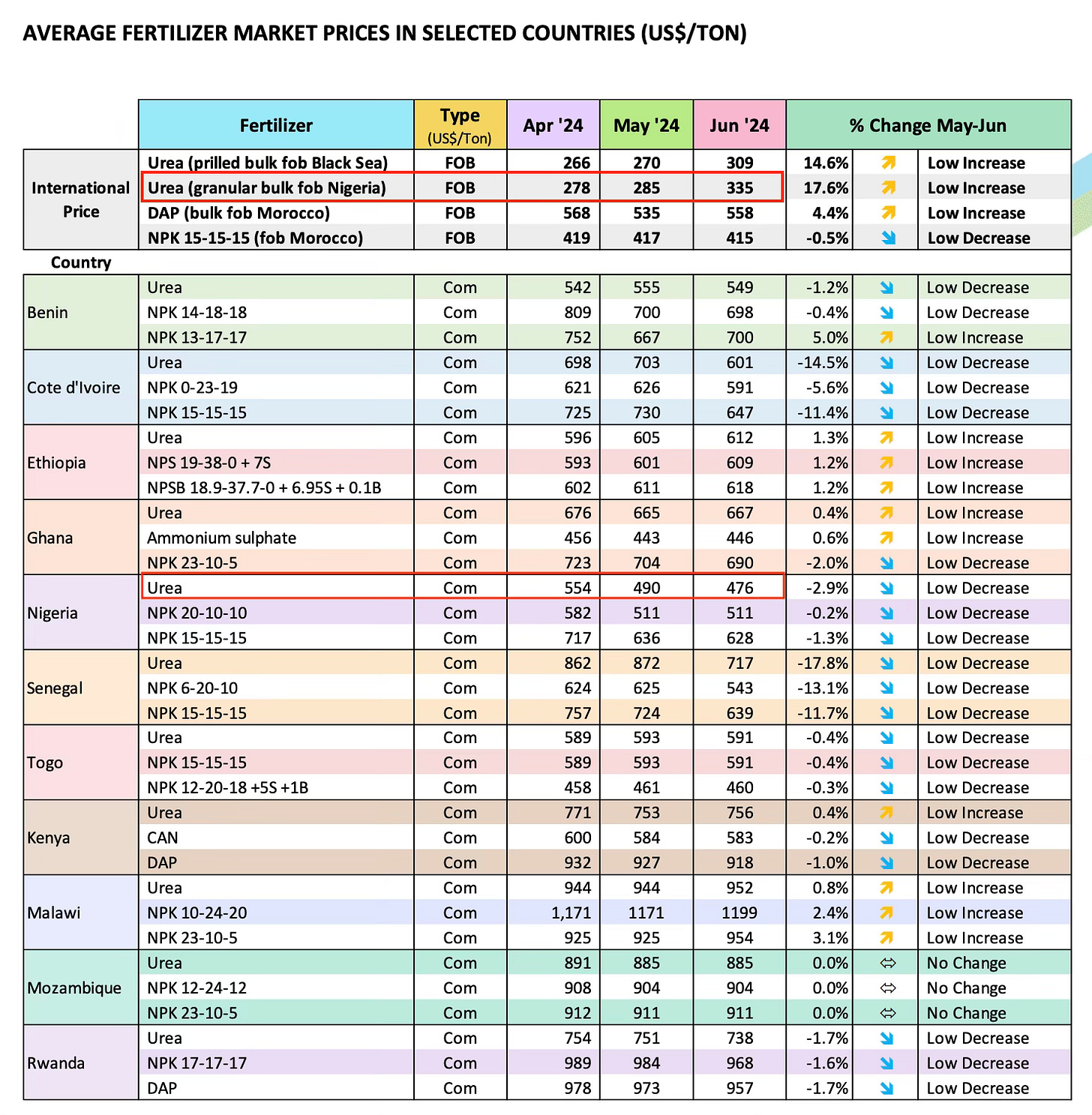

Because the best price data sits behind expensive paywalls like Argus, we are going to have to do some detective work to get a sense of prices over the last 12 to 15 months. Let’s start in July 2024 when Africa Fertilizer reported on June prices in Nigeria as follows:

Start with the first highlighted price - Urea (granular bulk fob Nigeria): in June this price was US$335/tonne. If someone outside of Nigeria wanted to buy from a Nigerian producer like Dangote or Indorama for shipping to their own country, this is the price they would pay (FOB stands for Free On Board and is basically the price at which the seller will load it on to a ship for you while you sort out all other costs after that, including shipping). Further down the table, you see that in the same month, urea prices in Nigeria were US$476/tonne. No, that is not a typo: prices in Nigeria were higher than prices for export.

Elsewhere in the document, we see another table (using Argus data) showing the comparable international price for Nigeria - Urea (granular, Middle East-all), fob bulk:

It bears repeating because it sounds really hard to believe but prices in Nigeria are higher than for export which are in turn higher than international prices. We can piece together more sources: in September 2024, Argus reported that Dangote sold 30,000 tonnes of urea at around US$337/tonne FOB. In November, another report said Dangote sold at US$330/tonne. In June of this year, Indorama was reported to have sold at just over US$390/tonne while Dangote sold at US$393/tonne.

In July of this year, West Africa Fertilizer Watch reported the following:

In July 2025, Nigeria’s fertilizer market experienced rising prices despite strong farming activity supported by consistent rainfall across much of the country. Demand for fertilizers has increased as farmers continue application, but supply challenges—particularly shortages of raw materials for NPK blending—have driven up costs and encouraged the circulation of adulterated products, keeping overall consumption lower than expected. Urea prices rose sharply, with the ex-factory rate increasing from ₦35,000 to ₦38,000 per 50kg bag, pushing the average retail price up 16% from ₦740,400 ($478) per ton in June to ₦863,600 ($563) in July.

In April of this year, a Middle East trading house did what it called a comprehensive analysis of the urea market and said Nigeria’s export output had reduced “due to domestic demand and production issues; prices range $355–400/ton FOB.”

When I first started looking at this (after a friend pointed it to me), I could not believe what I was seeing. Nigerian urea producers were enjoying very cheap subsidised gas - their most important input - and selling to Nigerians at eye-watering prices that were higher than international prices.

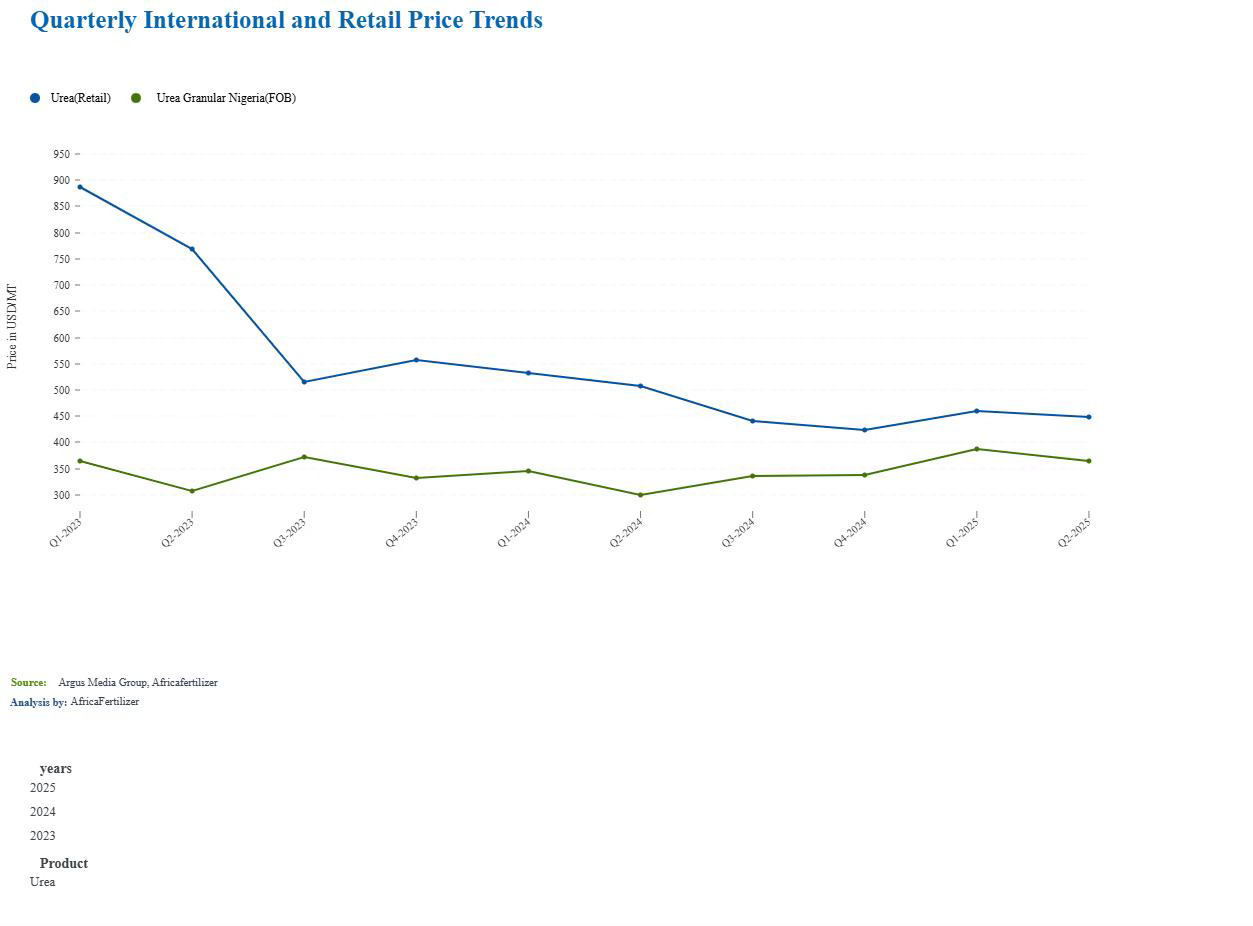

We can sum it up with the chart below - courtesy a friend with access to Argus data:

Going back to 2023, the price of urea in Nigeria (Urea retail) has been higher than the price for export at every point in time. It sounds like a sick joke but it is true. There is also something to be said about export discipline in this story, something we like to talk about a lot here. The Nigerian producers can barely impose their prices on the international markets because those buyers have a choice. But Nigerians are a captive market and it is to them they turn to extract the maximum possible profits without the risk of losing them as buyers.

When Sir William Crookes issued his rallying cry to science, and when pioneers like Haber and Bosch dedicated themselves to the monumental task of pulling nitrogen from the air, no Nigerian “entrepreneurs” were to be found contributing to this great human endeavour. So be it. But now, generations later, when this life-sustaining technology is well-established and readily available to address humanity’s most fundamental need - food - where do these figures finally appear? They emerge not as innovators or producers, but as gatekeepers. They position themselves squarely between this established technology and the Nigerian people, with the singular aim of extracting every possible dollar of profit from it. And all the while, the regulators and government officials who enable this brazen profiteering from public need stand idly by, a tacitly complicit audience to the spectacle.

At this juncture, the conversation need not turn to complex policy prescriptions or technical solutions. There is a more fundamental, human question that demands an answer, one I would put directly to those in authority who permit this and those who profit from it: Why?

This is digging deep, I really appreciate this, it's deeper than the shallow political scenes they keep feeding us.

Please keep educating us, we want change but we don't even know these things.

So Notore, Indorama and Dangote get their feedstock (and primary ingredient?) at a highly subsidised rate and sell to Nigerians at rip-off prices...

Nigeria is really a Gangstaz Paradise!!!